Tech Companies

Tax avoidance by large multinational tech companies has been one of the most important tax stories of the last decade.

The digitisation of the economy has created more opportunities for companies to shift profits offshore and sparked a series of initiatives by the OECD and governments around the world to reform their tax systems.

Our aim is to research and monitor the tax strategies of large multinational tech companies in order to better inform both the public and policy makers.

Broken offshore promises undermine the UK’s tax system

Even after years of attempts at reform, offshore havens still offer secrecy for those determined to hide money and evade tax. In a week when Britain’s Overseas Territories have ignored yet another deadline for functioning ‘beneficial ownership’ registers, new figures on UK tax enforcement stemming from the Pandora Papers show that leaks can’t supplant properly available information about who really owns offshore companies.

The gap in the Tax Gap

Quietly buried in HMRC spreadsheets released today is the news that the UK Tax Gap is consistently much bigger than HMRC previously said. New evidence suggests that the government may be under-estimating by several billion pounds the amount of income hidden offshore, and non-compliance amongst the largest and wealthiest taxpayers.

Starving HMRC will make it harder for Rachel Reeves to meet spending targets: TaxWatch responds to the CSR

Shrinking the £40 billion tax gap and £38 billion of outstanding tax debts is going to be critical for making today’s Spending Review numbers add up. Can HMRC deliver this with a real-term budget cut?

Donald Trump claims the UK’s Digital Services Tax overwhelmingly targets US tech giants. New data obtained by TaxWatch shows otherwise.

From the White House to the tech sector, the UK’s Digital Services Tax has been described as a discriminatory ‘tariff’ almost entirely targeting large US internet companies. New statistics show that’s not quite true.

“With hindsight, the wrong way to do it”

Why aren’t enablers of tax abuse being penalised? HMRC’s powers to sanction delinquent tax advisers have roadblocks built in, and there are still gaps in naming and shaming.

Glass half full? Are wealthy taxpayers underpaying more tax than we thought

HMRC is recovering more missing tax from wealthy individuals. But beneath the headlines: the tax this group is underpaying may be larger than previously thought, and is likely growing, while penalties for their non-compliance have plummeted.

Back to the drawing board

The government wants to step up the fight against enablers of tax abuse (again). New powers and better information can help. But HMRC is barely using the powers and penalties it already has.

Reducing UK’s Digital Services Tax: The high price of trade appeasement?

Scrapping the UK’s Digital Services Tax is the opposite of a good strategy in the face of a US trade war, when instead it should be reformed to operate better for the British public finances

Chancellor grasps at the magic money tree whilst tacitly admitting HMRC’s prosecution rates are so low they haven’t been deterring evasion.

Government’s Spring Statement hopes compliance and debt collection efforts pay off to recover more tax lost to avoidance

UK tax advice market needs urgent reform: TaxWatch’s new report highlights dangers of unregulated advisers and calls for change

TaxWatch launches new report illustrating the damage that a lack of regulatory oversight causes taxpayers seeking help to comply with their obligations & advocating for urgent widespread reform.

Curiously incurious: HMRC’s failures on tax evasion

The latest report from the Public Accounts Committee (PAC) paints a concerning picture of tax evasion in the UK retail sector. It highlights significant gaps in enforcement, underestimated scale of evasion, and a worrying decline in prosecutions. The report raises significant concerns about HMRC’s seemingly incurious approach to the scale of tax evasion.

Transforming Tax: HMRC’s digital and compliance revolution under scrutiny

A new report released today shows that HMRC’s costs are rising, but questions their efficiency and approaches to digitisation and compliance.

Late filing penalties where no tax is due: time for a different approach?

HMRC levy over £100m of penalties for late filing on 1.1 million individuals many of whom won’t owe any income tax. Such a policy is bad for our tax regime overall and undermines trust, it needs to change.

Labour’s softening on non-doms: interest groups over evidence or principle?

Rachel Reeves gives ground in replacement for the ‘non-dom’ rules in response to fearmongering ‘research’ claiming exodus of wealthy from the UK

Not pulling punches: Public Accounts Committee slams HMRC’s kid gloves approach to tax gap and criminal prosecutions

HMRC’s offshore tax gap estimate labelled “implausibly low” and raises concerns raised about lack of strategy for reducing the tax gap and lack of prosecutions

Anything to declare? HMRC slips out new R&D relief disclosure facility on New Year’s Eve…

Businesses who overclaimed R&D tax relief invited to disclose and repay with HMRC’s new disclosure facility, although it might not prove as popular as the Government hopes

A ‘guestimate not an estimate?’ PAC grills HMRC top brass about its lack of strategy on tax evasion in online retail

Public Accounts committee grill HMRC for not having a strategic plan nor reliable estimate for on tax evasion in online retail sector.

Private equity scores a huge Labour tax climbdown

Rachel Reeves gives unprecedented new tax discount to a few thousand fund managers worth nearly £500m a year by 2028-29 by moving, rather than closing, the ‘carried interest’ loophole

Raising Standards in the UK Tax Advice Market: The Government’s next steps appear to be a march into the long grass

The Government’s next steps to regulate and improve standards in the UK tax advice market betray the aims and findings of the recent consultation and demonstrate a lack of political will on the issue.

Declaring an interest – why HMRC’s hike in charges on late paid tax is so concerning

Autumn Budget increases interest charge on late paid tax debt, exacerbating problems with those struggling to pay. Interest seems to be used to raise revenue and drive compliance, a concerning development.

TaxWatch’s initial reaction to Autumn Budget 2024

Rachel Reeves’ first Autumn Budget makes for a mixed bag of delivering a fairer tax system whilst raising government revenue

New statistics show £300m lost to offshore tax gap on over 7million accounts held overseas likely to be gross underestimate

HMRC’s first estimate of the offshore tax gap for 2018, seems a wild underestimate at just £300 million based on questionable methodological choices.

State of Tax Administration 2024: Rising tax debts, falling customer services and misfiring compliance

TaxWatch launches our State of Tax Administration report, analysing HMRC’s performance in 2023-24

New statistics show HMRC’s clampdown on R&D claims beginning to take effect

Latest HMRC figures show the cost of R&D relief claims increasing but in relation to fewer claims being made for 2022-23. This implies HMRC’s compliance changes are discouraging claims that are less likely to be qualifying, especially those of lower value or in particular sectors.

Sweet Deception: £4.4bn tax evasion leaves a sour taste for HMRC

NAO calls out HMRC for not having a strategic plan on tax evasion.

Unveiling the latest Box office smash hit: Creative industry tax relief reach record highs

Record levels of tax relief claimed by the creative industries sector in 2023. The reliefs are now dominated by fewer, extremely large, claims for film and ‘high-end’ TV programmes. TaxWatch questions whether these reliefs offer good value for money given the profitability of expensive productions in light of changes to the Audio Visual Expenditure Credit.

The SME R&D tax relief scheme: lessons in how not to implement a tax relief

Once again, the National Audit Office qualified HMRC’s accounts due to a “material level of error and fraud in Corporation Tax research and development reliefs”. Whilst the good news is that the estimated error rate within the relief is coming down it remains unacceptably high. It has taken years for HMRC to admit there were problems, despite plenty of warnings, and action has been too slow to avoid the situation getting totally out of hand.

Mining the gap

TaxWatch analyses the latest tax gap data and examines manifesto pledges to narrow the gap to see whether they represent credible plans to increase tax revenues

HMRC’s 2024 Tax Gap report: Amount of tax going unpaid hits record high at £39.8bn in 2022-23

TaxWatch analyses the latest Tax Gap publication, noting it has reached £40bn in 2022-23 yet still doesn’t cover offshore matters

TaxWatch’s summary of the UK General Election party manifestos

TaxWatch reflects on the party manifestos for the upcoming General Election

The uncertain future of the UK’s Digital Services Tax

TaxWatch reflects on the Liberal Democrat proposal to hike Digital Services Tax

New age related Personal Allowance – rolling back the years?

Conservative Party to re-introduce age related allowances: TaxWatch’s thoughts on the proposal

What happens to the Finance Bill now an election’s been called?

The abrupt end to the Parliamentary session leaves several key Finance Bill clauses to the final washup day.

Can’t or won’t? HMRC’s lack of openness with recent FOI requests

HMRC is being elusive about the amounts due on specific offshore compliance penalties, providing confusing answers to Freedom of Information requests.

Will £51m really fix HMRC’s customer service helpline?

The Treasury’s additional funding for HMRC customer service is just a sticking plaster over an ingrained problem that needs a longer-term strategy and consistency of funding to resolve.

Are we nearly there yet? In search of the elusive offshore tax gap

HMRC now says offshore tax gap data will be published in June 2024, two years after the government announced it and a year after the information was due.

How to create a world class tax authority

TaxWatch published an article in Taxation magazine last week about the launch of the Funding the Nation report by ARC, the union for senior staff within HMRC.

Is HMRC fighting the right fight on avoidance schemes?

While HMRC appears to have stepped up activity against the promotion of tax avoidance arrangements, it seems that increased civil action is at best only containing the total number of schemes.

Gold plating tax reliefs for the silver screen

What are the implications of the additional fiscal support given to the creative industries in the Spring Budget, and do the changes provide value for money?

Latest Government consultation grapples with how to regulate tax advisers

TaxWatch introduces the latest Government consultation into regulating tax advice market.

TaxWatch responds to the Spring Budget 2024

The TaxWatch team focuses its thoughts on a few areas of the Budget statement it found particularly interesting, from a tax compliance and administration standpoint.

Would scrapping furnished holiday let tax benefits really raise £300m?

Abolishing preferential tax rules for furnished holiday lets owners will only raise the speculated revenue if the compliance rules are carefully thought out.

Fit for the future: Does HMRC have the right staff skills and technology?

HMRC’s effectiveness is being held back by legacy IT systems, staff and pay reductions and a lack of effective workforce planning.

Mind the gap: How to collect the right tax?

There are fundamental issues around the subject of compliance for HMRC, which needs, among other things, a proper workforce plan with trained and motivated staff able to deal with all aspects of compliance.

Seeing the wood from the trees: Putting HMRC wealthy compliance statistics in context

A report about trends in case numbers opened by a niche HMRC team requires a bit of context to judge whether the question it poses is the correct one.

Hanging on the telephone: The front line of HMRC’s customer service?

HMRC’s increasingly poor telephone service is impacting its ability to collect the right amount of tax and damaging the wider economy.

Taxing online selling: What’s really changing?

Misunderstandings and confusing media coverage last week have created uncertainty about how transactions made via online platforms such as Vinted, Ebay and Airbnb should be taxed.

TaxWatch launches regulatory complaint against Mr Douglas Barrowman

TaxWatch has lodged a formal complaint to the Institute of Chartered Accountants of Scotland in respect of its member, Douglas Barrowman.

How much tax did multinational companies underpay in the UK last year?

A recent story about multinational companies underpaying billions of pounds of UK tax caught our attention, but it turns out the figures aren’t quite what they seem.

Research & Development tax reliefs – never getting any easier

The government’s Autumn Statement 2023 continues to increase the complexity and administrative burden of the UK R&D regime.

TaxWatch responds to the Chancellor’s Autumn Statement 2023

Amongst the theatrical showmanship that characterises UK fiscal events TaxWatch pulls out a few of the more interesting announcements made in today’s Autumn Statement.

Investment allowances: Greasing the oil industry’s machine?

The extremely high level of tax relief available to the UK’s oil and gas companies compared to all other businesses has the potential to distort private sector investment, TaxWatch believes.

TaxWatch welcomes proposals to tackle promoters of tax avoidance

Two proposals in the draft Finance Bill 2023-24 aimed at tackling promoters of tax avoidance have been welcomed by TaxWatch.

TaxWatch releases latest report on the State of Tax Administration

Our latest annual report explores the UK Government’s administration and enforcement of the tax system.

Seven large tech groups estimated to have dodged £2bn in UK tax in 2021

New TaxWatch analysis shows how they appear to use complex tax driven structures to reduce their UK corporation tax.

TaxWatch’s view on Labour’s proposed Covid corruption commissioner

While it’s great news Labour is focusing on tackling fraud, real success depends on fully-funded public services to take appropriate action in those cases.

Holiday let tax rules allow owners to escape thousands of pounds in tax

The tax treatment of furnished holiday properties appears inappropriately generous and could encourage houses to be locked away to save thousands of pounds in taxes.

‘Our tax system is too complicated’ concludes Treasury Committee report on tax reliefs

The Treasury Select Committee has published a report into tax reliefs which calls for regular reviews and the removal of some.

Around £1bn per year lost to fraud and error in R&D tax relief claims

HMRC’s initial data into R&D tax relief claims shows significant underestimates in previous calculations of fraud and error in the schemes.

HMRC’s 2023 Tax Gap report: Proportion of tax going unpaid unchanged from previous year

The amount of tax lost in the 2021-22 financial year was 4.8% of the total tax owed, the same figure as the previous year.

Public Accounts Committee says HMRC not doing enough to deter tax cheats

HMRC must do more to deter and punish tax cheats.

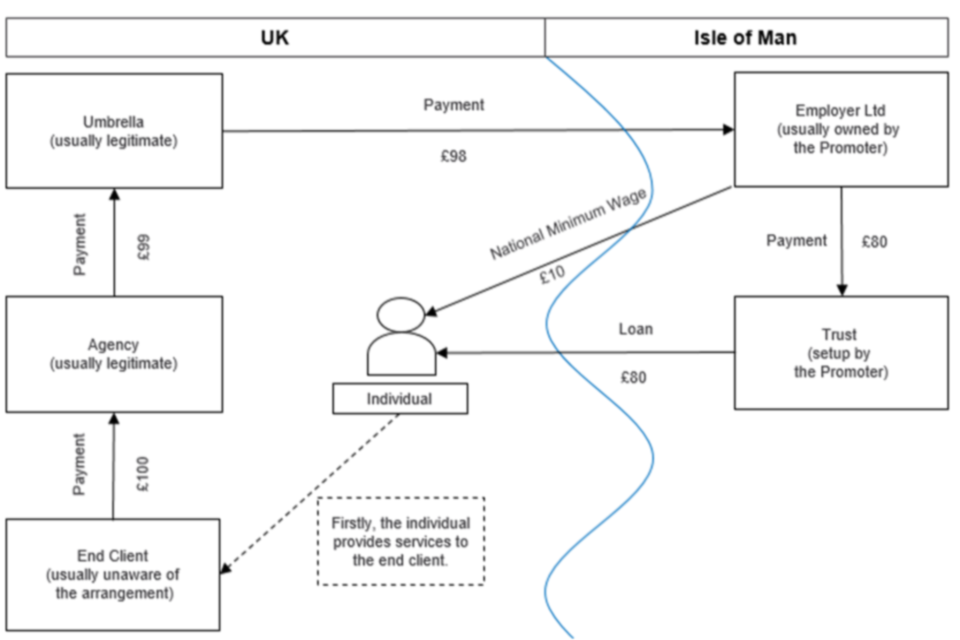

Beyond the Loan Charge: Will the most recent proposals finally shut down disguised remuneration schemes?

HMRC estimates that 31,000 people used disguised remuneration schemes in 2020-21.

Can a posse of professional bodies clean up tax dodge city?

What – if anything – can be done about professionals that break the rules?

HMRC tax defaulting tax advisor reported to two professional bodies

TaxWatch complains to professional bodies about deliberate tax defaulter.

Director of suspected HMRC tax avoidance scheme continues to be member of professional body

An accountant ‘named and shamed’ by HMRC for alleged involvement in tax avoidance schemes is still a member of ICAEW.

Video Games Tax Relief costs five times as much as forecast

Video Games Tax Relief (VGTR) cost a record £197m last year, more than five times as much as it was anticipated to cost.

Public Account Committee questions resourcing of HMRC

A new PAC report argues that the government is “missing the opportunity to recover billions”

TaxWatch give evidence at Treasury Select Committee

TaxWatch Acting Director Alex Dunnagan gave evidence to the Treasury Select Committee on 19th December highlighting the abuse of tax reliefs.

ITR Global Tax 50 2022: Alex Dunnagan

Acting Director Alex Dunnagan has featured in International Tax Review’s list of the 50 most influential figures in global tax.

Opportunities Missed – Autumn Statement 2022

The Chancellor has missed an opportunity to close the tax gap.

TaxWatch submits regulatory complaints against arms dealer’s adviser.

TaxWatch’s third complaint to the professional bodies.

Funding of Taxpayer Protection Taskforce raises serious issues

The failure of Sunak’s taskforce highlights concerns over how HMRC compliance is funded.

Cross-party MPs call time on feeble approach to tax avoidance and urge HMRC to prosecute tax fraudsters

New report argues how supposedly ‘legal’ tax avoidance could actually be prosecuted as tax fraud

Tax Gap Op-Ed in HMRC Magazine

We have recently had an op-ed published in the magazine HMRC Enquiries, Investigations and Powers.

We need to talk about Corporation Tax

No, the UK is not set to become a high-tax global outlier.

HMRC publishes its 2022 Tax Gap – TaxWatch analysis

HMRC’s Tax Gap increases for second year in a row on a like-for-like basis.

Differing approaches to combating marketed tax avoidance schemes

HMRC’s record on tackling marketed tax avoidance schemes over the last 10 years.

Amazon – Public money but no public scrutiny

Investors have a chance to increase transparency in Amazon’s tax affairs.

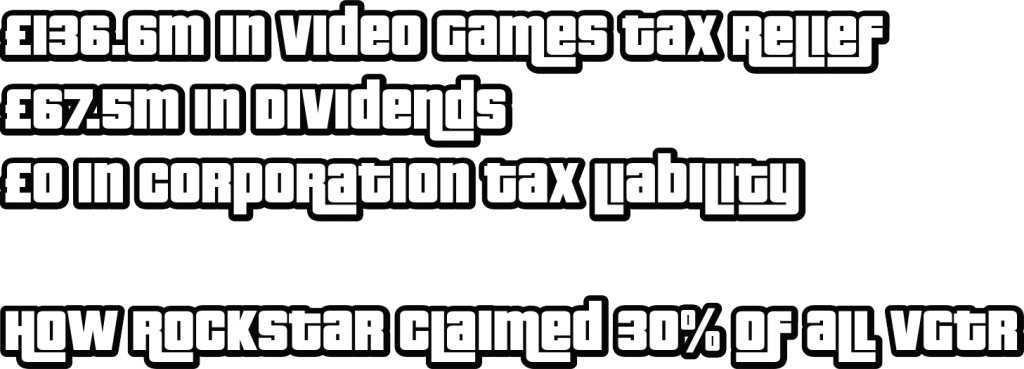

Another record year for Rockstar Games Tax Relief (RGTR)

Rockstar games claimed £68.4m in VGTR in 2020-2021, almost double what the whole relief was set to cost on a yearly basis.

TaxWatch launches regulatory complaint against Mr Arthur Lancaster of AML

TaxWatch has lodged a complaint concerning Arthur Lancaster, Director of AML Tax (UK) Limited, and Director of the Knox House Trust of the Isle of Man.

Organised Crime in the Department of Health and Social Care supply chain

TaxWatch is calling on the Department of Health and Social Care (DHSC) to investigate the fraudulent use of Mini Umbrella Companies in its procurement process.

HMRC’s record on covid support and tax fraud under the microscope

HMRC’s record on tax fraud has been questioned by two select committees and in several parliamentary debates in recent weeks

TaxWatch launches annual report on state of tax administration

TaxWatch is today launching its annual report on the state of tax administration in the UK.

TaxWatch launches complaint against “Mr Red”

TaxWatch has submitted a complaint to the Tax Disciplinary Panel about the conduct of an individual identified as “Mr Red” in the case of Murray Group Holdings vs HMRC.

The gift that keeps on giving

GTA developer takes close to 50% of all video game tax relief in 2020.

HMRC reveals new estimate for Covid fraud recovery

Three-quarters of Covid support claimed in fraud and error won’t be collected

Funding to fight covid related tax and benefits fraud

Analysis by TaxWatch has found that the DWP is spending more than twice the amount being spent by HMRC on recovering an increase in fraudulent payments arising from the pandemic.

Use of disguised remuneration avoidance schemes more than doubled after Loan Charge

New analysis shows that the number of users of disguised remuneration schemes has increased dramatically despite government attempts to legislate against the schemes.

TaxWatch challenges HMRC over “sweetheart” deal with GE

TaxWatch has launched the first stage of legal proceedings against HMRC over their decision to settle a £1bn tax fraud dispute with GE.

How should HMRC treat the victims of tax fraud?

HMRC’s policy of “process now check later” can easily be abused by fraudsters.

The Diverted Profits Tax and Tackling Offshore Promoters of Tax Avoidance

A TaxWatch Briefing on the Finance Bill 2021-2022.

Budget 2021 – Four tax takeaways

We analyse the Autumn budget, looking at compliance work, promoters of tax avoidance, R&D relief, and the environment.

Video Games Tax Relief – 2021 Update

£180m paid out in Video Games Tax Relief last year, the vast majority to large multinationals.

US set to raise $8.5bn from four tech companies following global tax deal

US Government set to raise 3x more than rest of the world combined in tax payments from four tech companies after Global Tax Deal.

G7 tax deal represents a tax cut for big tech in the UK – new analysis

A new analysis from TaxWatch has demonstrated that tech giants will end up paying less tax under the proposals put forward by the G7 than they are currently liable for under the digital services tax.