Rockstar Games UK Limited (previously Rockstar North) has finally published it’s 2020 accounts, more than one year late. In fact, the publication of Rockstar’s accounts are so late that the company’s 2021 accounts are already overdue. The recently filed 2020 accounts reveal that the video game developer was entitled to £56.6m in Video Game Tax Relief (VGTR) in the 12 months to 31 March 2020. This large sum was almost half of the total VGTR paid out that year. The total amount of claims for VGTR is going up ever year, as is the amount paid out, but despite this, Rockstar appear to be capturing more and more of this relief.

The Edinburgh based games studio, which is owned by American video game giant Take-Two Interactive Software, is responsible for the development of the multi billion dollar Grand Theft Auto (GTA) series. As we wrote in Gaming The Tax System, while the UK based company develops the games, they don’t publish them, with a structure set up to ensure that the UK company turns very little profit, and therefore has little to no corporation tax liability.

VGTR – What is it?

Video Games Tax Relief was introduced by the UK government in 2014 to provide targeted support for games that were “culturally British”, with a particular focus on support for small and medium sized businesses. The idea at the time being that only smaller publishers would be interested in producing games aimed solely at the British market.

The relief works by adding notional costs to the video games producer’s accounts, reducing the taxable profit or increasing losses. Developers can deduct an extra 25% of qualifying expenditure from their taxable profit. If the game’s production company is loss-making then the developer can claim a cash credit from HMRC.

Rockstar Returns

After filing their annual return nine months late with Companies House, Rockstar’s annual accounts are finally publicly available.

Before looking at the state of Rockstar’s 2020 finances, it’s worth noting that there is a large restatement for their 2019 accounts. It was previously reported that in the year end 31 March 2019, Rockstar’s turnover was £119m and the cost of sales was £56m. These numbers have now been adjusted to show that they were actually £231m and £167m. The reason given is that there was an error in the way that staff incentive payments were accounted for, and that “in the prior period these costs have been netted off in error against intercompany rechage income”, when in fact they should have been recorded. This is quite a significant accounting error. The impact it has on VGTR claims, if any, is not known.

Turning back to the 2020 figures, Rockstar turned a pre-tax profit of £9.63m over the reporting period, but once taxation is taken into account, that number increases by £65.16m to £74.78m. The vast majority of this increase is made up by the effect of VGTR, with the remainder coming from the effects of things such as deferred taxation and changes in valuation allowance. As a result of VGTR, Rockstar was able to pay out £40m in dividends over the year.

|

2016 |

2017 |

2018 |

2019 |

2020 |

Total |

|

|

Operating Profit |

£3,515,268 |

£3,745,345 |

£8,242,790 |

£8,715,917 |

£9,519,819 |

£33,739,139 |

|

Tax on profit |

£33,416,310 |

£13,121,157 |

£26,915,315 |

£40,035,440 |

£65,155,510 |

£178,643,732 |

|

Of which VGTR |

£11,278,530 |

£11,918,339 |

£19,116,178 |

£37,607,824 |

£56,684,144 |

£136,605,015 |

|

Profit after tax |

£36,931,578 |

£16,884,972 |

£35,216,097 |

£48,773,567 |

£74,783,921 |

£212,590,135 |

|

Dividends |

£0 |

£12,500,000 |

£15,000,000 |

£0 |

£40,000,000 |

£67,500,000 |

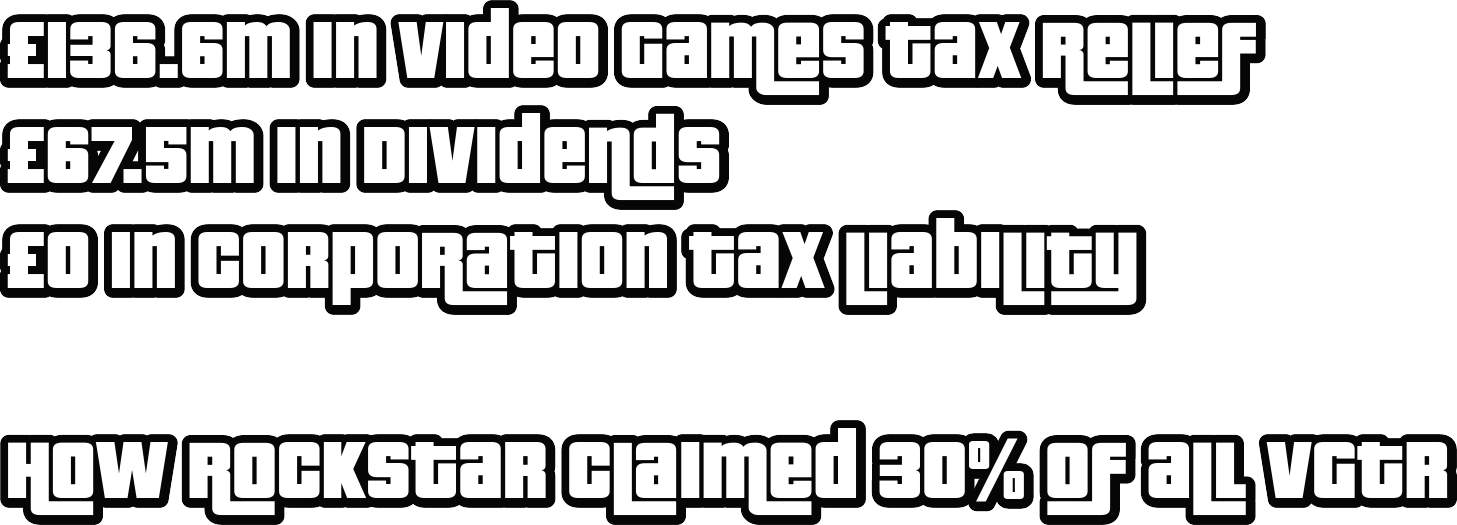

The last year for which Rockstar listed taxation as a liability was 2015, when the tax was listed as a cost of -£718k. In the first five years since the introduction of the relief, Rockstar’s accounts show the company accruing £136.61m in VGTR, with total taxation for the period actually showing £178.64m in credit.

Despite only having an operating profit of £33.74m over this five year period, Rockstar was able to pay out twice that (£67.5m) in dividends to shareholders due to the subsidy the company receives from the British Government.

By the end of March 2020, 1,000 games had received “Culturally British” accreditation, 1This number has since increased, and statistics are available for the year up until end of March 2021. However, we are only looking at Creative Industries data up until the end of March 2020 as this … Continue reading a pre-requisite for VGTR.2For more on this ‘cultural’ accreditation, and how a game set in the US about gangland crime can be classed as ‘culturally British’, see – Swedish goats, Japanese hedgehogs and Batman: the … Continue reading Of these, two were published by Rockstar, with Grand Theft Auto V receiving the accreditation in 2015, and Red Dead Redemption 2 in 2019.

Studios are able to make interim claims before a game is completed, with the relief related to the production spend. The large claims from Rockstar for the 2019/2020 financial year are likely to be related at least in part to Red Dead Redemption 2, and possibly to the production costs of new games such as a future instalment of the GTA franchise, and potentially updates to GTA Online and Red Dead Online, although there may be other games in the works that we are unaware of. With Rockstar accounting for £136.6m of VGTR by March 2020, a company with fewer than 1% of the games qualifying for VGTR is set to capture over 30% of the total subsidy.

In 2018-19, 535 video games made 345 claims and received £103 million,3A claim may cover several games. with Rockstar accounting for some 37% of this.4We wrote about this at the time with our blog post Rockstar Takes The Pot, with TaxWatch analysis featuring in the Sunday Telegraph. Just as we thought the amount of VGTR hoovered up by a single multinational couldn’t increase, in 2019-20, 605 games made 350 claims and received £121m, with Rockstar accounting for some 47% of this. – despite having not released a game since October 2018.

Video Games Tax Relief was estimated to cost just £35m a year when it was introduced.5“It is estimated that this generous new corporation tax relief will provide around £35 million of support per year to the sector.”, Video games companies to begin claiming tax relief, HM … Continue reading However, we are now seeing just one company claim alone claiming more than that.

In October last year we said:

“Seven years from the introduction of VGTR, questions need to be asked as to whether this is achieving its initial aim, creating culturally significant games and helping British developers, or is it a scheme gone awry, with hundreds of millions in taxpayer cash subsidising successful multinational enterprises?”6Video Games Tax Relief – 2021 Update, TaxWatch, 14 October 2021, http://13.40.187.124/video_games_tax_relief_2021/

Rockstar’s recent accounts show how it’s more necessary than ever for the UK Government to review the effectiveness of this relief. For this US owned company, VGTR is the gift that keeps on giving.

References

| ↑1 | This number has since increased, and statistics are available for the year up until end of March 2021. However, we are only looking at Creative Industries data up until the end of March 2020 as this is the most recent reporting period for Rockstar. Data available at – Video Games Certified as British through the cultural test for video games, BFI, https://www.bfi.org.uk/apply-british-certification-tax-relief/cultural-test-video-games |

|---|---|

| ↑2 | For more on this ‘cultural’ accreditation, and how a game set in the US about gangland crime can be classed as ‘culturally British’, see – Swedish goats, Japanese hedgehogs and Batman: the £324 million tax bung to the ‘culturally British’ gaming industry, TaxWatch, 20 November 2019, http://13.40.187.124/cultural_test_tax_relief/ |

| ↑3 | A claim may cover several games. |

| ↑4 | We wrote about this at the time with our blog post Rockstar Takes The Pot, with TaxWatch analysis featuring in the Sunday Telegraph. |

| ↑5 | “It is estimated that this generous new corporation tax relief will provide around £35 million of support per year to the sector.”, Video games companies to begin claiming tax relief, HM Treasury, 19 August 2014, https://www.gov.uk/government/news/video-games-companies-to-begin-claiming-tax-relief |

| ↑6 | Video Games Tax Relief – 2021 Update, TaxWatch, 14 October 2021, http://13.40.187.124/video_games_tax_relief_2021/ |