Yesterday HMRC published its annual statistics on the tax relief for Research & Development (R&D) in the 2022-23 tax year. The main findings were:

- A fall in the number of claims made, down 21% to 65,690. Most of the fall was concentrated in the SME scheme, which fell by 23%;

- The value of claims has increased marginally (1%) to £7.5bn, driven by an increase in higher value claims;

- The average value of each claim has increased dramatically by 28%;

- Administration and compliance changes made by HMRC appear to be having an impact on the volume of claims;

- It’s unclear whether these trends are wholly good news (non-qualifying projects are not being claimed for) or bad (claims that would qualify are now being put off by bulk/poor quality compliance checks, with these innovations moving overseas).

Anyone following the saga of the UK’s R&D tax regime in recent years is probably not surprised by the most recent statistics published by the department. The regime has been tightened up considerably, triggered by HMRC’s Random Enquiry Programme, indicating that at its highest a quarter of SME R&D claims were non-compliant. The resultant changes made the scheme less generous and increased the administration requirements for claimants. An unannounced raid of the business premises of a large claims agent firm earlier this week demonstrates HMRC are willing to use their powers to pursue criminal charges of cheating the public revenue against the company’s directors.

What the new statistics tell us about who is claiming the relief

Digging deeper into the latest figures, what’s telling is that changes made to the R&D scheme back in Autumn Statement 2022 are starting to feed through. TaxWatch welcomes signs that taxpayers have been put off submitting claims that were unlikely to qualify for the relief, rather than have to repay erroneous claims with interest and potential penalties, addition to the fee they paid to the claim agent, which is likely to be irrecoverable. There’s been a sharp contraction in the number of claim agents operating in this area, with the market taking some time to re-adjust.

The combination of falling estimates of fraud and error within the SME regime (down to 14.6% in the 2022–23 Annual Report[1]), declining volumes of lower value claims as well as claims in sectors targeted by advisory firms that deceive businesses, such as social care, nurseries, and the hospitality industry, we are likely to see fewer taxpayers caught up in the mis-selling scandal that has plagued the relief.

(Source: Corporate tax: Research and Development Tax Credits – GOV.UK (www.gov.uk))

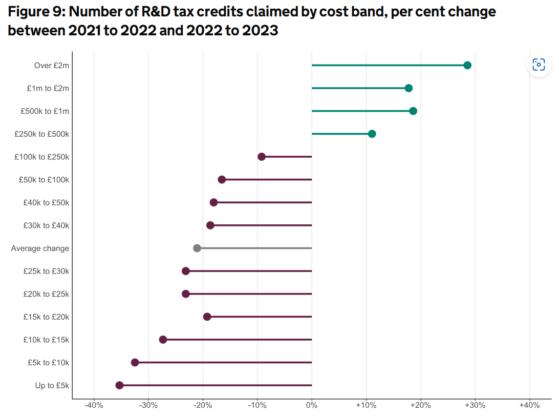

Overall the number of claims worth £15,000 or less has fallen very significantly and by a greater proportion than the overall average. This is to be welcomed, given the improbability of making a scientific or technical breakthrough as a direct result of such a small investment by the claimant company. Claims of at least £250,000 have increased in number and value in real terms – reflecting more generous terms of the large company RDEC regime.

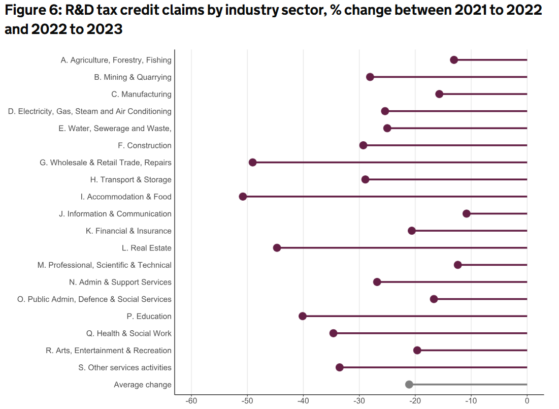

There is also welcome news that the number and value of claims in sectors that are less likely to be qualifying, such as accommodation & food and education, which have anecdotally been targets of mis-selling by rogue agent claim companies, are declining.

(Source: Corporate tax: Research and Development Tax Credits – GOV.UK (www.gov.uk))

Is HMRC’s job ‘done’?

Whilst it’s welcome to see the situation for R&D relief improving, problems remain. Bulk compliance checks by teams within HMRC seem to be of varying quality, and projects that are well prepared and apparently qualifying have been reported to be being struck out by officers, leading to the enquiry process getting bogged down in statutory reviews and some recent tribunal decisions. Resourcing the HMRC teams to conduct well targeted compliance is a challenge.

The other risk for the regime going forward (given the new merged expenditure credit regime has taken over alongside the Enhanced R&D Intensive Support ‘ERIS’ sub-scheme from April 2024), is that innovative projects, that should be the focus for the incentive, fear the UK regime is overly protracted and offers insufficient certainty. This could cause these firms to place their R&D functions outside the UK, damaging the new UK Government’s focus on growth.

With the coming Autumn Budget in just over a month there is a decision to be made about whether the regime should continue to accept claims for low value projects and whether further tightening of eligibility is required to justify the amounts spent on the subsidy.

[1] HM Revenue and Customs – Annual Report and Accounts 2023 to 2024 (publishing.service.gov.uk) p.243