TaxWatch’s Director, George Turner, wrote an op-ed for the Independent setting out why the government’s recent Tax Gap figures should be treated with caution.

The article sets out how the government’s estimates of tax avoidance vastly underestimate the true scale of the problem.

The full article can be accessed here:

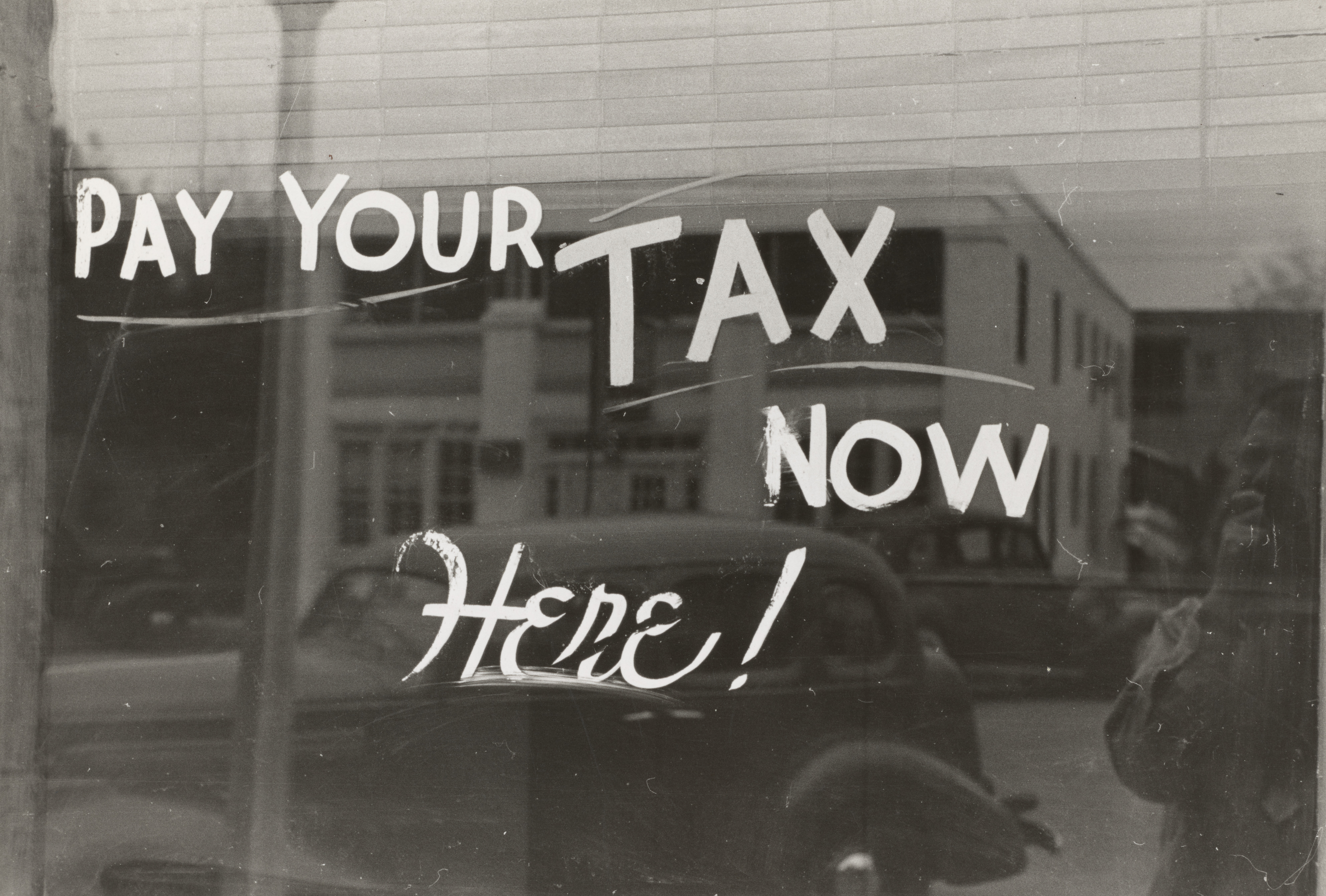

Photo by The New York Public Library on Unsplash