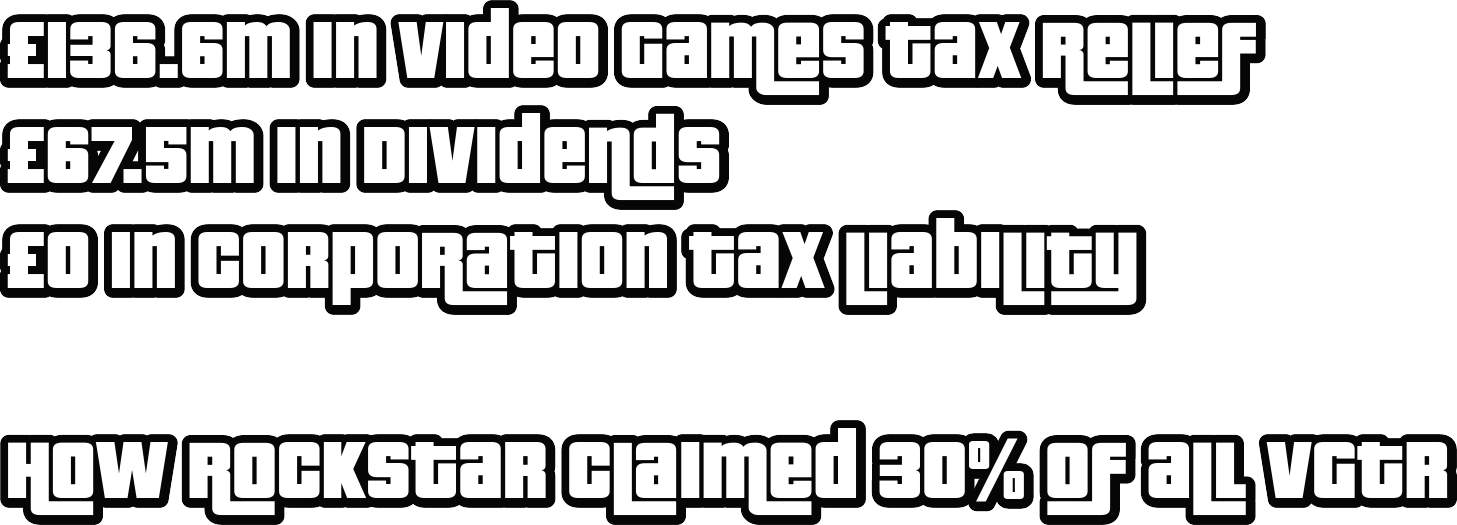

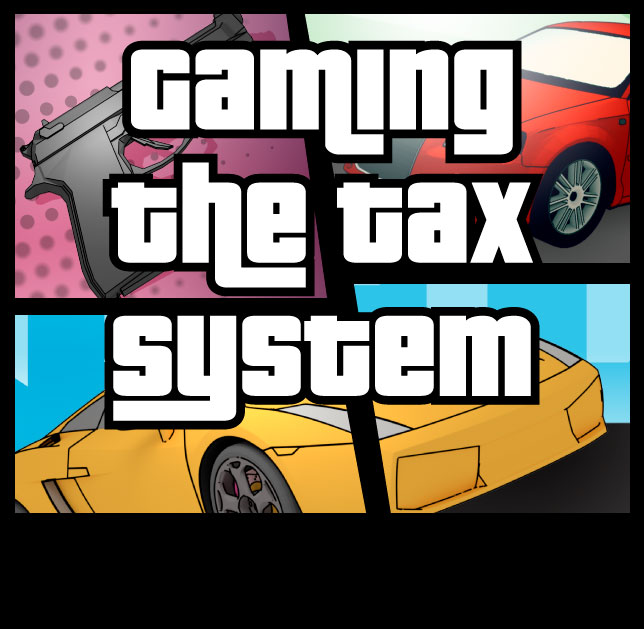

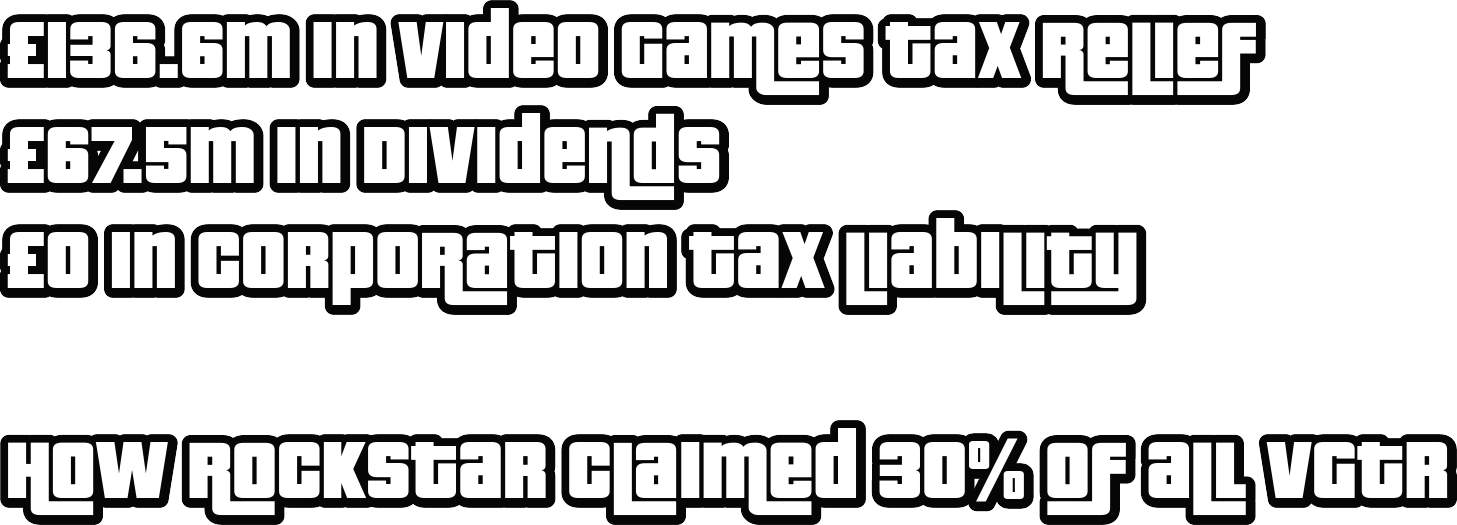

by Alex Dunnagan | Jan 19, 2022

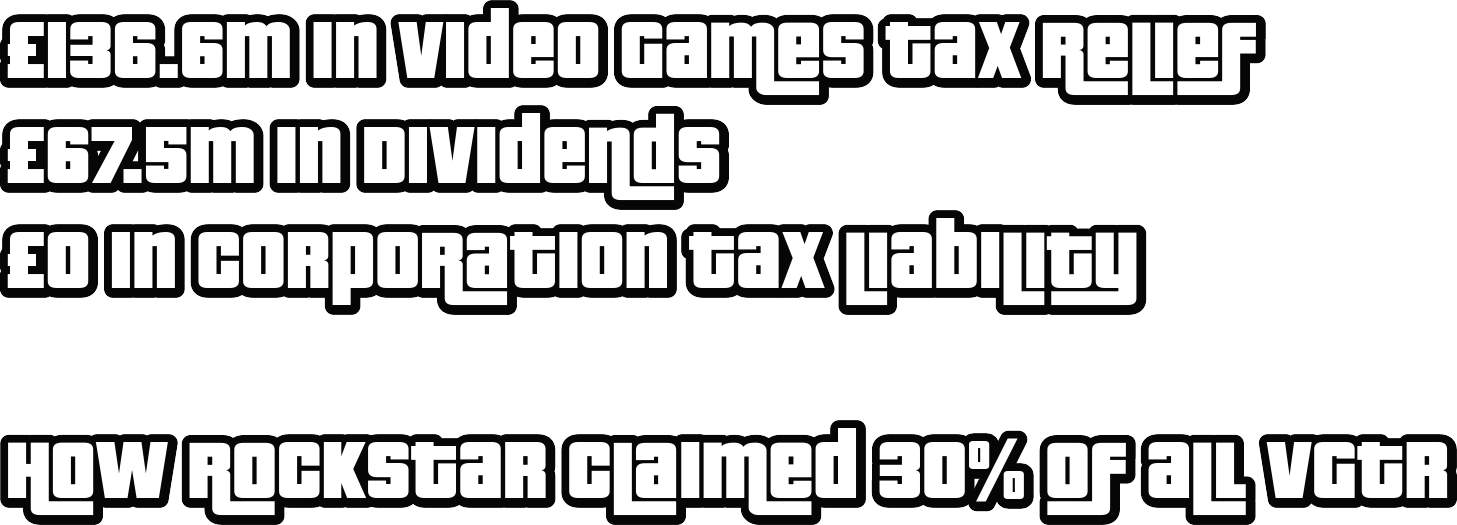

Rockstar Games UK Limited (previously Rockstar North) has finally published it’s 2020 accounts, more than one year late. In fact, the publication of Rockstar’s accounts are so late that the company’s 2021 accounts are already overdue. The recently filed 2020...