by Dr Pete Sproat | Apr 24, 2023

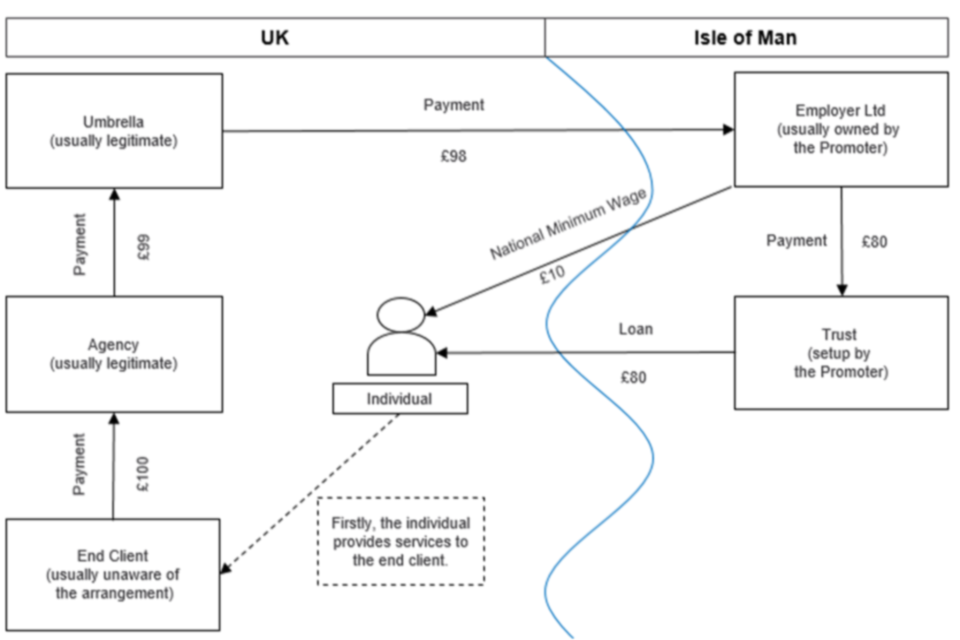

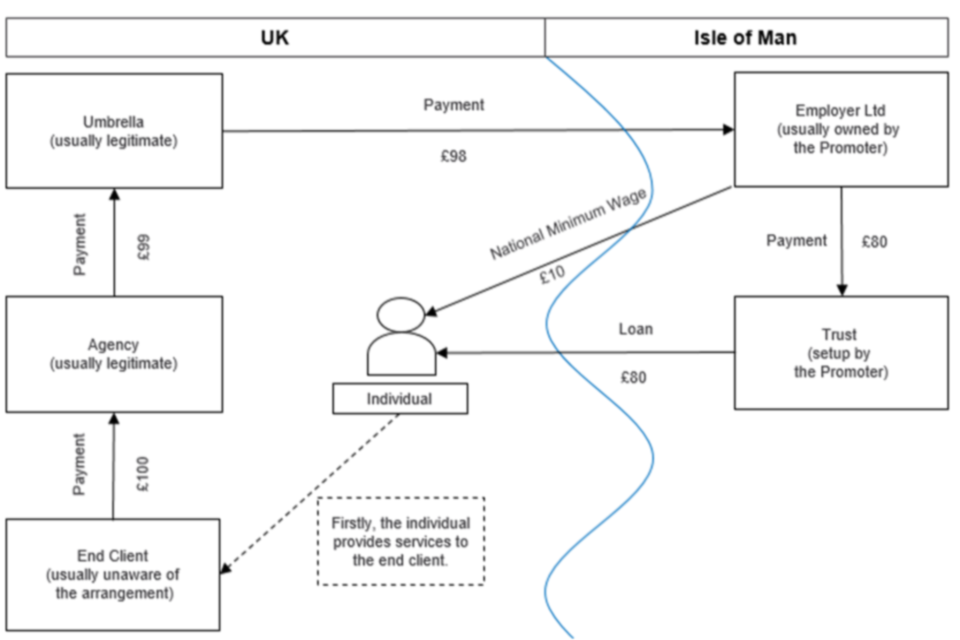

In 2016 Chancellor George Osborne declared the introduction of the loan charge would “shut down disguised remuneration schemes”. Yet HMRC estimates 31,000 people used such schemes in 2020-21, resulting in a loss of £400m in tax. The authorities have attempted to...

by George Turner | Jun 7, 2022

Taxation magazine recently carried an article from our Executive Director looking at HMRC’s record on tackling marketed tax avoidance schemes over the last 10 years. The article looks at the differing results HMRC has achieved going after two different types of...

by George Turner | Mar 21, 2022

TaxWatch has lodged a complaint concerning Arthur Lancaster, Director of AML Tax (UK) Limited, and Director of the Knox House Trust of the Isle of Man. Mr Lancaster is both a member of the Chartered Institute of Taxation and the Institute of Chartered Accountants of...

by George Turner | Dec 7, 2021

New analysis shows that the number of users of disguised remuneration schemes has increased dramatically despite government attempts to legislate against the schemes Criminal investigations against promoters remain a rarity, with no successful prosecutions being...

by Alex Dunnagan | Nov 6, 2020

On Monday 26 October our Executive Director George Turner gave evidence to the Finance Bill Sub-Committee of the House of Lords, with regards to disguised remuneration and the draft Finance Bill 2020-2021. Greg Sinfield, President of the First-tier Tribunal (Tax...