by Claire Aston | Feb 5, 2025

Over 1.1m of UK taxpayers miss the deadline for submitting their self-assessment return deadline for 2023/24 of 31 January 2025 Automatic £100 late filing penalty automatically due, rising to £300 if the return remains outstanding by end of April Penalty is charged...

by Claire Aston | Jan 30, 2025

Photo credit: Sky News The Labour government’s recent announcement at Davos of changes to their (non UK domiciled) ‘non-dom’ policy marks a significant retreat from one of their few concrete tax commitments. Speaking at the World Economic Forum, Chancellor...

by Claire Aston | Nov 28, 2024

Photo credit: Bill Noble/Reuters Rachel Reeves gives unprecedented new tax discount to a few thousand fund managers worth nearly £500m a year by 2028-29 One of the few concrete tax proposals within the Labour Party’s successful General Election manifesto was the...

by Claire Aston | Nov 6, 2024

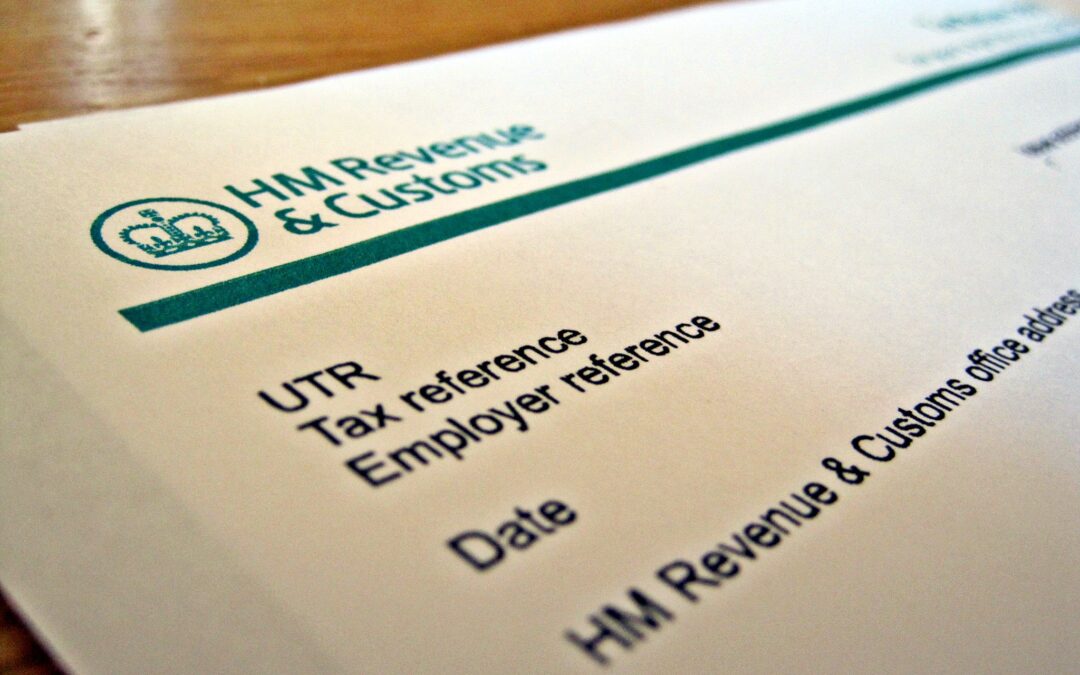

Significant increase in interest charged on late paid tax of 1.5 percentage points, reaching 8.75% from April 2025 expected to exacerbate debt problems for those already struggling to pay £1.1bn of additional revenue expected over 5 years, nearly half from income tax...

by Claire Aston | Jun 14, 2024

At the end of the week of the political party manifestos for next month’s UK General Election, the TaxWatch team have been looking through the various pledges concerning tax from a compliance and administration lens and summarise our thoughts below. Labour Party All...

by Claire Aston | May 28, 2024

With last week’s announcement of a General Election on 4th July, the TaxWatch team have been looking at tax related pledges coming out of the main UK political parties. The first of note is the Conservative Party’s announcement of a new age-related Personal Allowance...