by Alex Dunnagan | Dec 29, 2021

UK Government has announced an extra £510m boost to DWP to fight benefits fraud following the pandemic. This is in addition to £103m already announced in the spending review HMRC spending £155m to tackle covid related fraud TaxWatch estimates the increase in benefits...

by George Turner | Dec 7, 2021

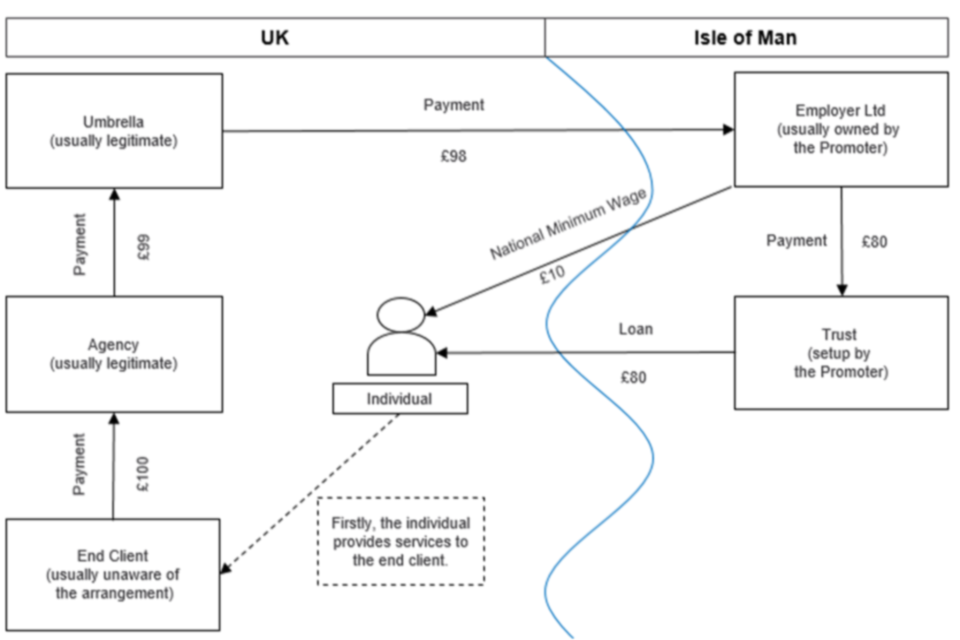

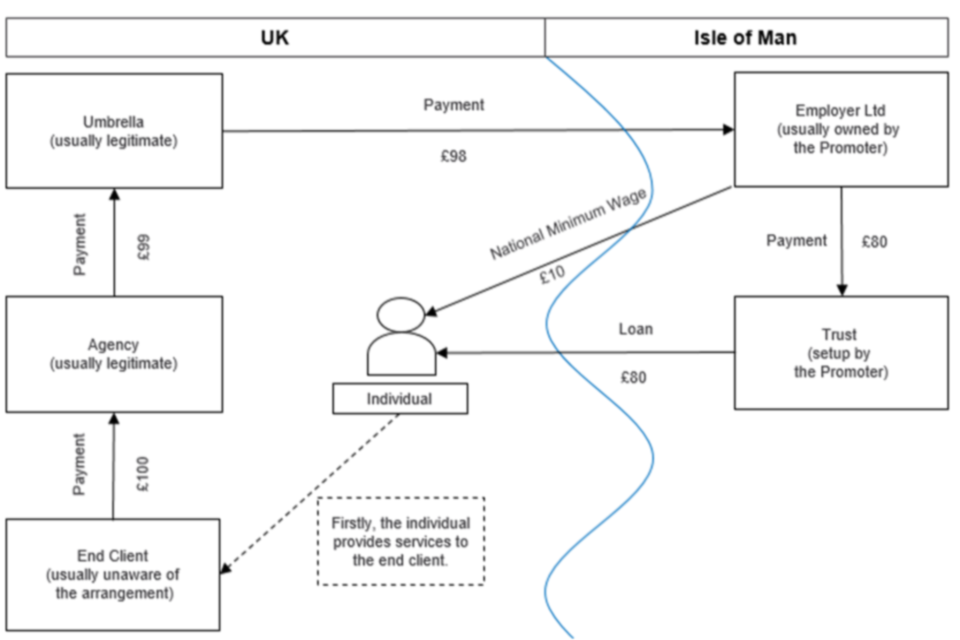

New analysis shows that the number of users of disguised remuneration schemes has increased dramatically despite government attempts to legislate against the schemes Criminal investigations against promoters remain a rarity, with no successful prosecutions being...

by George Turner | Dec 6, 2021

TaxWatch has launched the first stage of legal proceedings against HMRC over their decision to settle a billion pound tax fraud dispute with GE. On 15th September it was reported that GE had reached a settlement with HMRC over a dispute involving a tax avoidance...

by George Turner | Dec 2, 2021

What should be the tax liability of people who are the victims of fraud? That is the important question raised by the case of Mike Grogan, reported in The Times last weekend. Mr Grogan is one of a number of victims of tax advisor fraud, where scam tax advisors make...

by Alex Dunnagan | Dec 1, 2021

The Finance Bill 2021-22 was published earlier in November, legislating for tax changes announced at the Autumn Budget. This briefing focuses on two aspects of the bill, amendments to the Diverted Profits Tax and measures relating to the promotion of tax avoidance...