by Mike Lewis | Feb 27, 2026

Today the National Audit Office (NAO) publishes its first assessment in over a decade of how effectively HMRC is chasing the missing tax revenues of Britain’s biggest companies. TaxWatch was pleased to give evidence to the NAO’s enquiry, whose headline...

by Jack McConnel | Dec 18, 2025

As the year turns, 2026 will see the start of the biggest change in a generation for how nearly three million people will do their taxes: the catchily-titled Making Tax Digital for Income Tax Self Assessment (MTD for ITSA). From April 2026, digital record-keeping and...

by Chris White | Dec 2, 2025

Last week’s Budget underscored the government’s struggles to balance the books without raising taxes or cutting services. Yet one source of lost revenue – offshore tax evasion – remains persistently under-policed and under-discussed. It appeared...

by Mike Lewis | Nov 26, 2025

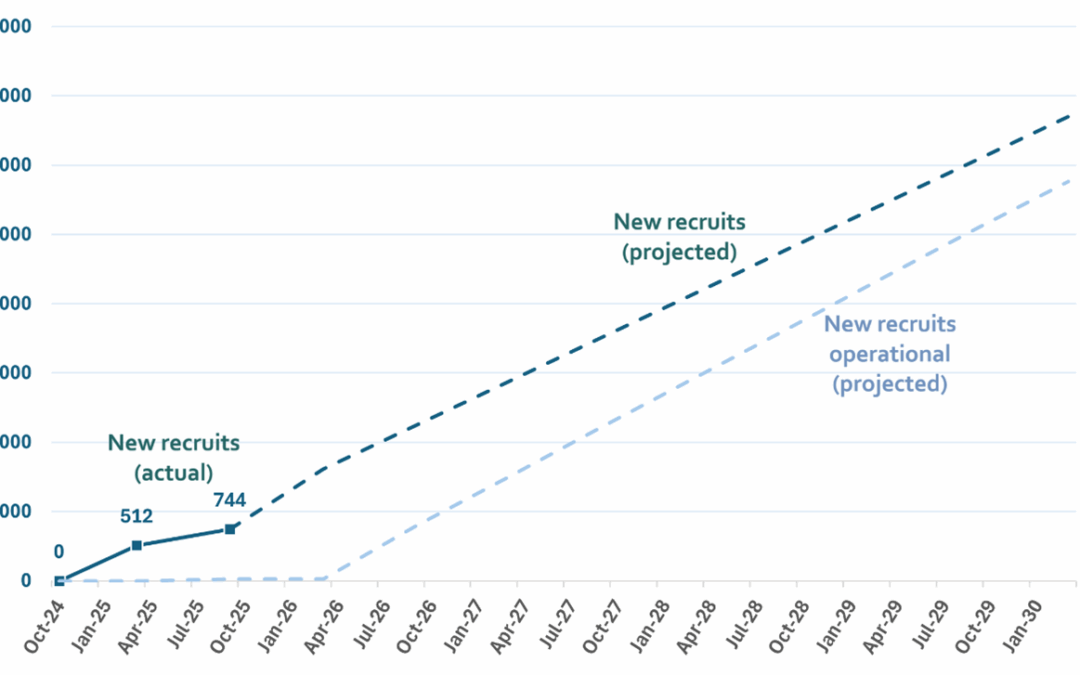

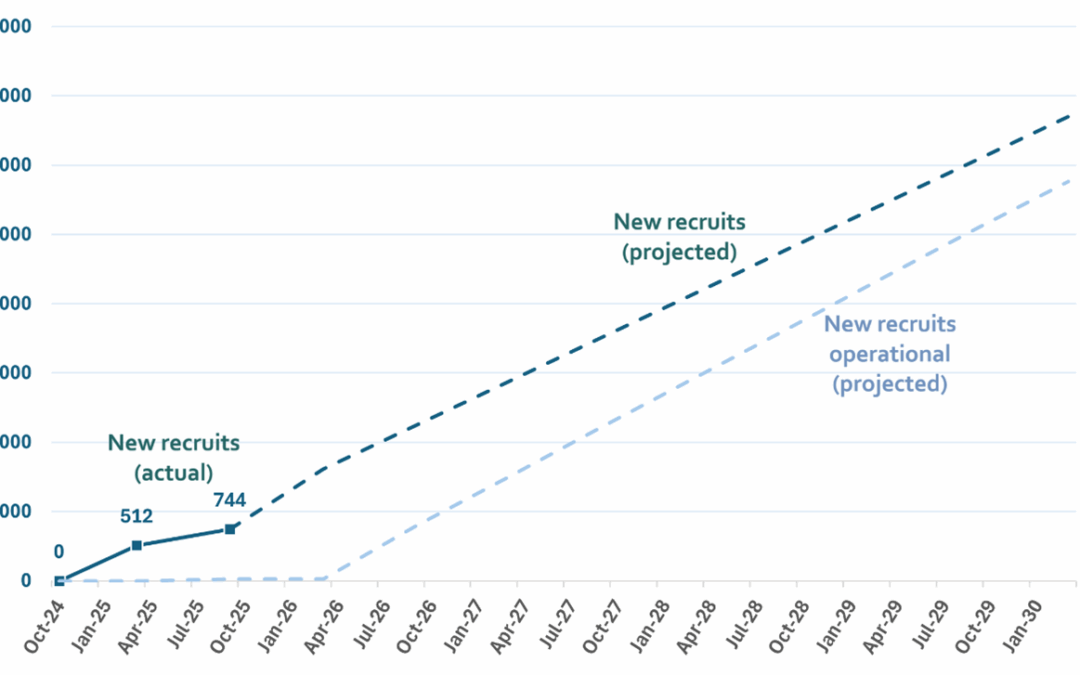

Budget’s third-largest tax pledge relies on UK tax authority that is suffering from recruitment delays and unfinished IT systems Just 26 of 6,700 extra compliance/debt staff promised by Chancellor are so far in post Decision to retain tax on digital...

by Mike Lewis | Nov 19, 2025

What is Rachel Reeves’ second-biggest revenue-raising policy so far? As well as being a question for the most niche pub quiz ever, It’s something that would be near-impossible to guess from the public debate in the run up to this year’s Autumn...