by Chris White | Dec 2, 2025

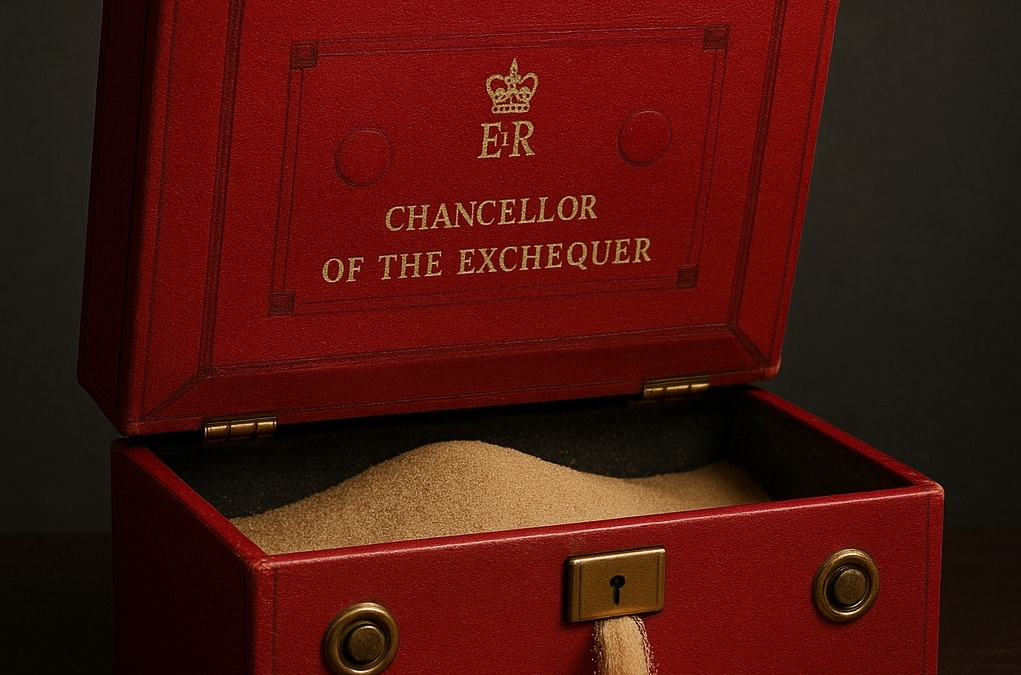

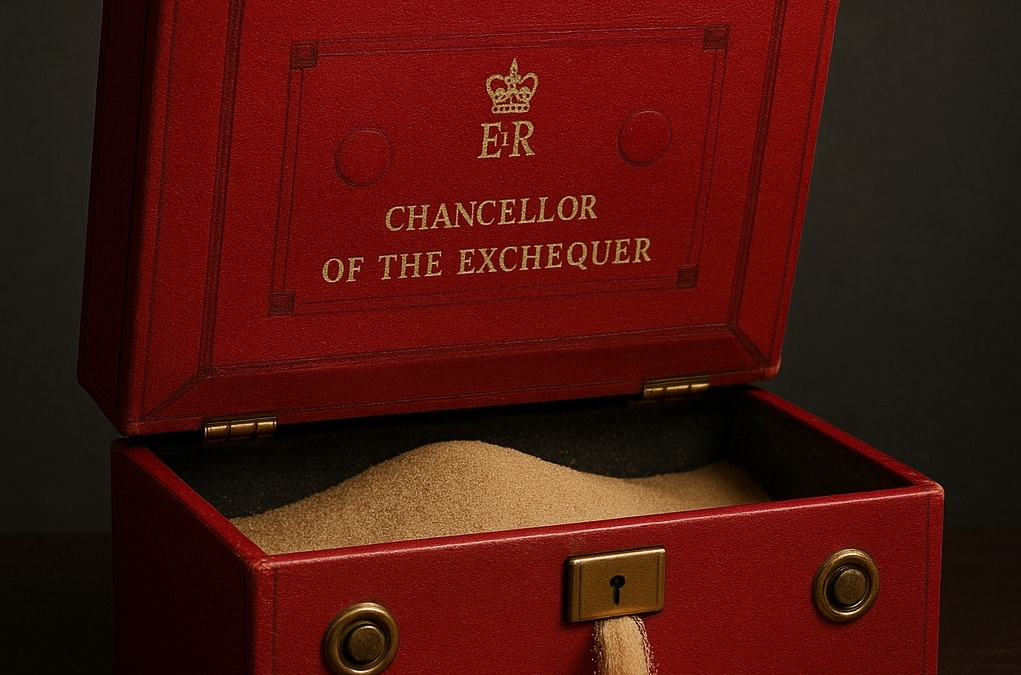

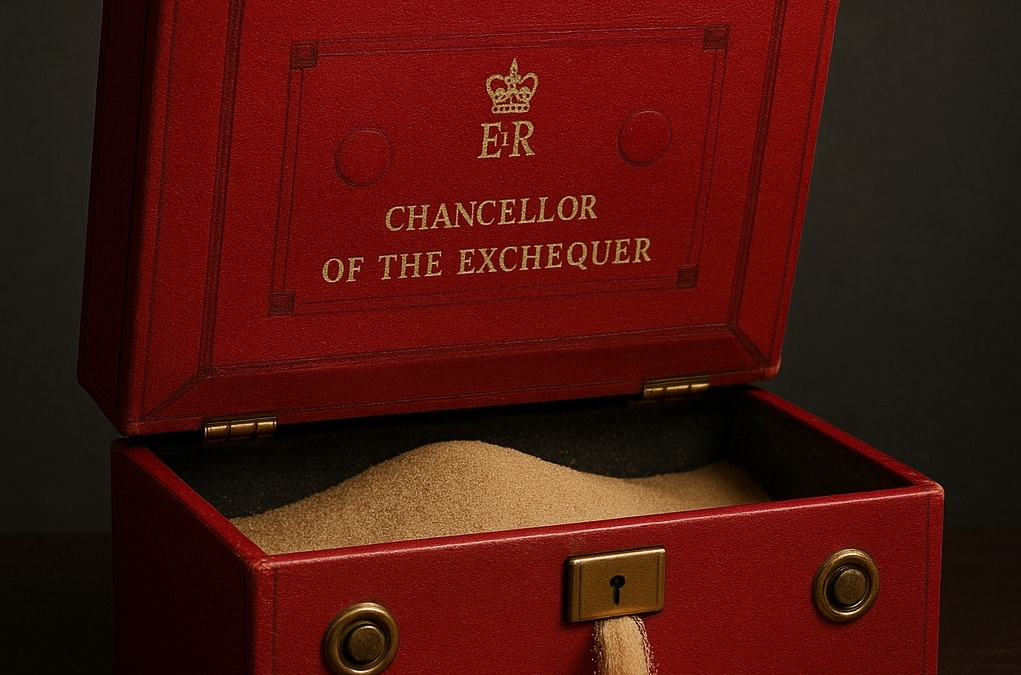

Last week’s Budget underscored the government’s struggles to balance the books without raising taxes or cutting services. Yet one source of lost revenue – offshore tax evasion – remains persistently under-policed and under-discussed. It appeared...

by Mike Lewis | Aug 29, 2025

The UK is in a fiscal tight spot. The Chancellor has promised to raise an additional £7.5 billion over the next four years by boosting HMRC compliance efforts. The Autumn Budget is likely to see more measures intended to make this number go up: perhaps extra...

by Claire Aston | Jan 7, 2025

Error and fraud within R&D tax relief reached £1.1bn in 2020-21 (24% of all claims) before HMRC took action to stem the losses and tighten up the claims processes. New disclosure facility launched for businesses who overclaimed R&D relief wanting to set their...

by Claire Aston | Feb 21, 2024

It’s good to see national newspapers showing an interest in HMRC performance data and raising important issues about properly funding our tax authority. However, a recent article in The Guardian about trends in case numbers opened by a niche HMRC team requires a bit...

by Alex Dunnagan | Mar 15, 2023

Nothing for HMRC compliance despite huge returns on investment Increases in sentencing for tax fraud and potential new tax offence– only useful if HMRC successfully prosecutes Tax to be simplified – we’re still not sure exactly how R&D reformed yet again Generous...