How Activision Blizzard has moved billions of dollars of profit into tax havens

4th August 2019

-

Activision Blizzard, publisher of hit games Call of Duty, World of Warcraft and Candy Crush moved €5bn to companies in Bermuda and Barbados between 2013-2017, documents reveal.

-

The company is currently under investigation by tax authorities in the UK, Sweden and France over alleged transfer pricing irregularities and is is facing a potential bill of over $1.1bn in back taxes and penalties.

-

In the United States, Activision Blizzard has recently settled a transfer pricing dispute with tax authorities for $345m.

-

The multinational company has a complex structure with subsidiaries in a number of tax havens including Malta, the Netherlands, Barbados and Bermuda.

A PDF version of this report is available here.

Activision Blizzard is one of the most successful video games companies in the world. Headquartered in Santa Monica, California, the company’s hit titles include the World of Warcraft, Guitar Hero and Call of Duty, along with the massively popular mobile phone game Candy Crush Saga. The company is listed on the New York Stock Exchange and has a market cap of $37bn as of August 2019, making it significantly larger than rivals Electronic Arts, Take-Two Interactive and Ubisoft.

The company is the product of several mergers and acquisitions, and is divided into three groups, Activision, Blizzard, and King. Activision developed Guitar Hero and Call of Duty. Blizzard was merged with Activision in 2009 and is responsible for the development of World of Warcraft. King, originally a Swedish company but now headquartered out of London, is responsible for mobile games such as Candy Crush.

Whereas Activision and Blizzard seem to have integrated much of their structure and operations, King still forms a separate group of companies under the Activision Blizzard umbrella.

The company has had a controversial tax history in recent years. Activision Blizzard recently settled with the IRS following an examination of the company’s 2009-2011 tax returns. This saw the company having to make an additional tax payment of $345m in relation to transfer pricing issues.

In 2018, the French tax authority handed Activision a bill of $652m following a transfer pricing investigation into one of the company’s French subsidiaries for the tax years 2011-2013. The company says it vigorously disputes the claim.

The Swedish tax authority handed the company a $400m dollar bill in 2018 following an audit of their 2016 tax year. The company also says it will vigorously contest the claim.1

The company is also subject to other ongoing tax investigations and demands.

Responding to these tax controversies, Activision Blizzard have suggested that the company is now seeking to mend its ways. The company told the Sunday Times:

“We have proactively engaged with, and continue to fully collaborate with, both HMRC and other tax administrations globally to agree to the proper amount of tax due in each jurisdiction during a period of changing policies and rules.

For King, since the acquisition we have been reviewing the structures in place and we are seeking multilateral conversations among the UK, Sweden, Malta and US tax authorities by which those respective administrations would allocate our income among their respective jurisdictions.

We are a committed employer in the UK and look forward to reaching a final conclusion on the allocation of our taxable income around the world.”

In this report we explore the different structures of Activision Blizzard and King group companies and demonstrate how Activision Blizzard moves billions of dollars from its non-US operations into tax havens.

Activision and Blizzard

Activision – Revenues 2018 $2.7bn ($897 EMEA)

Blizzard – Revenues 2018 $2.3bn ($692 EMEA)

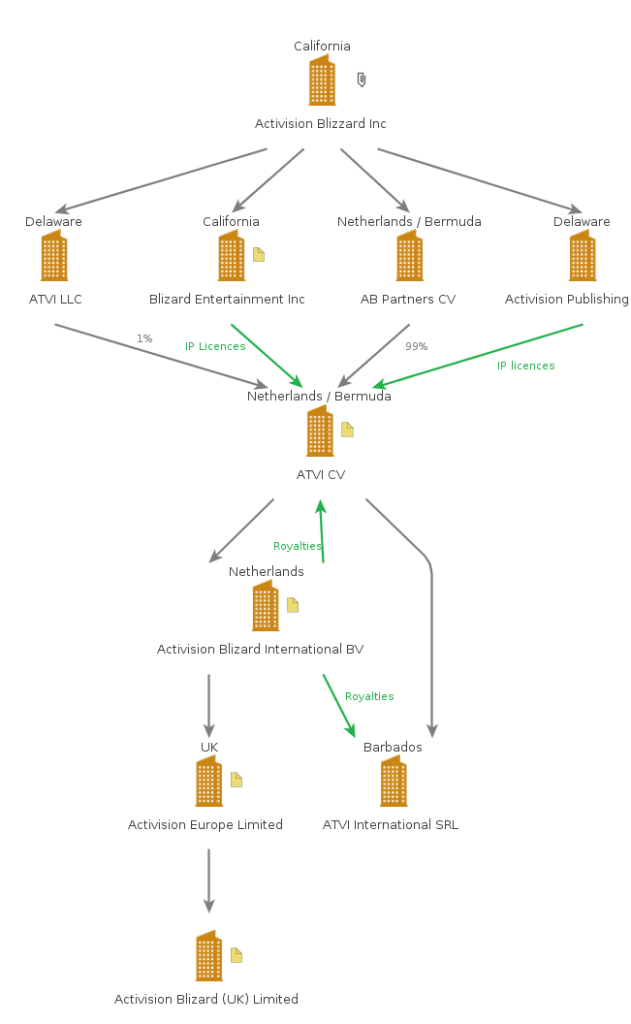

Selected companies in the Activision Blizzard group

Activision Blizzard formed when Activision merged with Blizzard from Vivendi Games in 2009. The new company was majority owned by Vivendi, the French media giant, until 2013 when it became independent.

The company has a highly complex corporate structure which appears to work as follows: Activision and Blizzard companies in the US sell intellectual property rights (IP) to a Dutch partnership which is resident in Bermuda, ATVI C.V., and a subsidiary of ATVI, ATVI International SRL in Barbados. These entities then sublicense the IP to a Dutch company, Activision Blizzard International BV.2

Activision Blizzard International BV

Activision Blizzard International BV is responsible for the exploitation of these rights and managing the distribution of the products outside the US. This includes running the World of Warcraft servers, sub-licensing games to third party distributors, and distributing the game to local subsidiaries of Activision Blizzard for sale in their markets. The company earned €1.66bn from these activities in 2017.

Activision Blizzard International barely makes a profit, because much of the revenue it earns it needs to pay out as a royalty to the two offshore companies ATVI C.V. and ATVI International SRL. In 2017 Activision Blizzard International made profits before tax of just €55.6m, on which it paid just €7.2m in taxes. It paid €1.3bn in royalties to ATVI C.V. and ATVI International SRL.

In the five years between 2013 and 2017, Activision Blizzard International BV paid out €5bn in royalties. The vast majority of these royalties went to ATVI C.V., the Dutch partnership based in Bermuda. However, in 2017 ATVI C.V. transferred some of their IP to ATVI International SRL in Barbados. The result of this is that in 2017 about 50% of the royalties paid by Activision Blizzard International B.V. went to ATVI C.V.. We assume that the other 50% went to ATVI International SRL, however, the accounts of that entity are not publicly available.

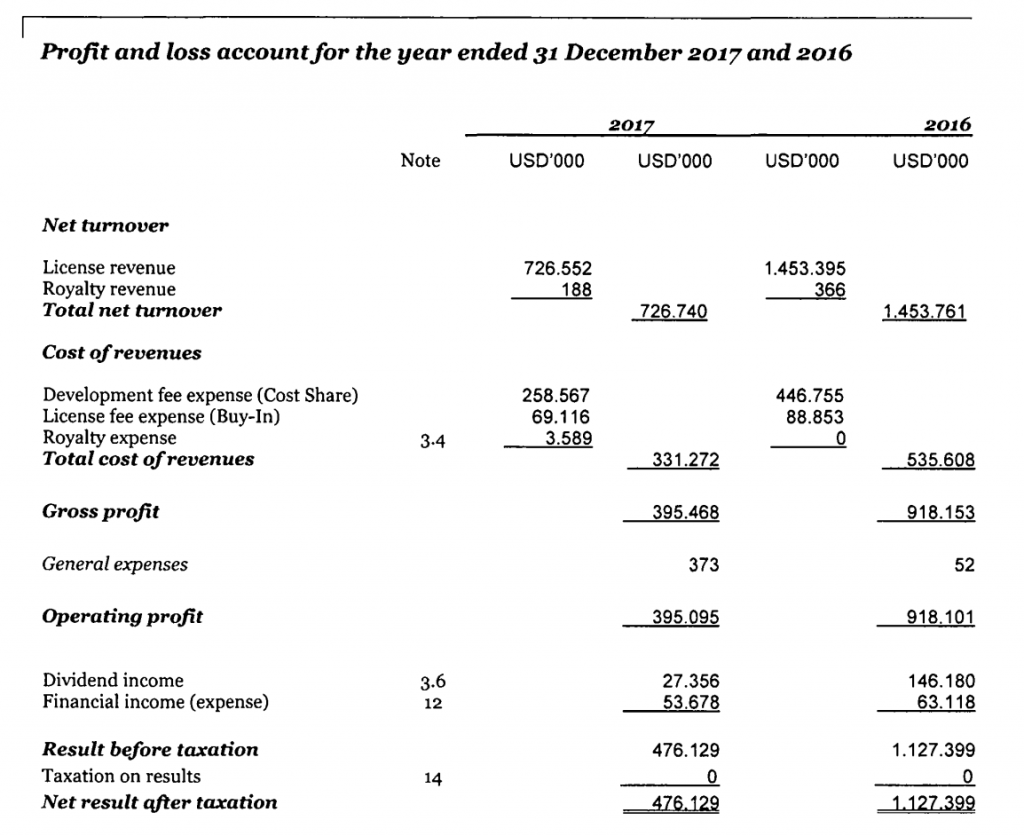

The accounts of ATVI C.V. showed that that company generated profits of $476m in 2017 and $1.1bn in 2016 on which it paid $0 in taxes.

ATVI C.V. has 0 employees. The company’s costs are the cost of buying the intellectual property from Activision Publishing Inc and Blizzard Entertainment Inc in the US, who are responsible for developing the games.

It is this relationship that was the focus of an IRS transfer pricing investigation, with the IRS apparently taking the view that ATVI C.V. should have been paying more to the US for the IP rights. As a result ATVI C.V. had to make an additional payment of $1.4bn to Activision Publishing Inc and Blizzard Entertainment Inc, for the period covering 2009-2016. This settlement resulted in an increased tax bill of $345m.

The 2017 Profit and Loss account for ATVI C.V.

Activision Blizzard UK

In the UK, the main Activision Blizzard company is Activision Blizzard UK. This company describes its activities as a publisher and distributor of video games. The company makes significant revenues. However, the accounts show that it makes little profit in the UK.

In 2017 the company had an income of £75m, on which it made a profit before tax of just £516,000. In 2009, the company recorded sales of £455m, on which it made a profit before tax of just £22m – a profit margin of just 3.6%. In that year the company had a tax liability of £4m.

It should be noted that the revenues that appear in the Activision Blizzard UK are not all of the revenues generated by the company from UK customers.

In the latest annual accounts of the US parent company, Activision Blizzard Inc, it is stated that the UK market comprises of 12% of the total revenues of the company. If we apply that to just the revenues for Activision and Blizzard ($4.8bn in 2017), we get total estimated UK revenues of $572m in 2017. The large difference between the amount generated from UK sales, and the amount of revenue in the accounts of Activision Blizzard UK, will be accounted for by the fact that Activision Blizzard International BV in the Netherlands will generate its own income from UK customers via sales of games to third party distributors and subscriptions to the World of Warcraft servers.

With regard to revenues that are made in the UK, the profit margin on those revenues is small because Activision Blizzard UK is described as a “limited risk distributor”.3HMRC describes a limited risk distributor as a distributor which buys goods and sells them like any other, but where risks and functions are transferred back to the principal company (in this case Activision International BV). An example of how a company could limit risk is by agreeing to buy back any unsold stock so that the distributor only ends up selling stock it knows it can get rid of.4

| Activision Blizzard UK LTD | ||||||||||

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | Totals | |

| Turnover | £455,452,472 | £342,359,000 | £248,463,000 | £220,704,000 | £150,839,000 | £149,540,000 | £98,094,000 | £62,085,000 | £75,192,000 | £1,802,728,472 |

| Cost of Sales | -£395,558,263 | -£300,389,000 | -£206,905,000 | -£185,300,000 | -£114,641,000 | -£107,295,000 | -£56,730,000 | -£33,222,000 | -£47,156,000 | -£1,447,196,263 |

| Gross Profit | £59,894,209 | £41,970,000 | £41,558,000 | £35,404,000 | £36,198,000 | £42,245,000 | £41,364,000 | £28,863,000 | £28,036,000 | £355,532,209 |

| Gross Margin | 13.15% | 12.26% | 16.73% | 16.04% | 24.00% | 28.25% | 42.17% | 46.49% | 37.29% | 19.72% |

| Admin Expenses | -£31,614,781 | -£30,026,000 | -£33,769,000 | -£28,117,000 | -£29,998,000 | -£36,206,000 | -£36,585,000 | -£26,255,000 | -£26,305,000 | -£278,875,781 |

| Distribution Costs | -£11,868,685 | -£6,450,000 | -£2,529,000 | -£3,292,000 | -£2,648,000 | -£2,490,000 | -£1,915,000 | -£1,052,000 | -£1,010,000 | -£33,254,685 |

| Other Expenses | n/a | n/a | n/a | n/a | n/a | n/a | -£11,000 | -£7,000 | -£156,000 | -£174,000 |

| Operating Profit | £16,410,743 | £5,494,000 | £5,260,000 | £3,995,000 | £3,552,000 | £3,549,000 | £2,853,000 | £1,549,000 | £565,000 | £43,227,743 |

| Operating Margin | 3.60% | 1.60% | 2.12% | 1.81% | 2.35% | 2.37% | 2.91% | 2.49% | 0.75% | 2.40% |

| Profit before Tax | £22,302,191 | £4,321,000 | £4,497,000 | £3,789,000 | £3,185,000 | £3,086,000 | £2,685,000 | £1,734,000 | £516,000 | £46,115,191 |

| Tax | -£4,139,071 | -£984,000 | -£1,362,000 | -£1,788,000 | -£977,000 | -£2,438,000 | -£355,000 | -£88,000 | -£7,984,000 | -£20,115,071 |

| Profit for the year | £18,163,120 | £3,337,000 | £3,135,000 | £2,001,000 | £2,208,000 | £648,000 | £2,330,000 | £1,646,000 | -£7,468,000 | £26,000,120 |

The fact that Activision Blizzard is a limited risk distributor allows the corporation to argue that less profit should be allocated to the UK. This profit is instead allocated to the “risk taker” – Activision Blizzard International BV, which sees its profits eliminated with their royalty costs.

According to the accounts of Activision Blizzard UK Limited, the company is currently in discussions with HMRC over its ‘international business model’. It has set aside £8.5m as a provision in relation to tax investigations currently underway dating back to 2013. This provision is equal to 43% of the total tax liability of the company in the UK over the last ten years. The investigation is likely to be focusing on whether the allocation of profit to the UK company is fair.

Activision France

The UK is not the only authority currently in a dispute with Activision Blizzard. In December 2017 the French Tax Authority issued a re-assessment of the company’s tax bill between 2011 and 2013 due to transfer pricing issues they found at one of the company’s French subsidiaries. The total tax bill demanded including penalties and interest was €571 million.

The company says they dispute the claim and will vigorously defend it through the courts if necessary.

UK taxation of royalties

As TaxWatch has written about previously, the UK government has introduced a new tax on royalties shifted to some tax havens, including Bermuda (but not Barbados) where those royalties originate from a UK source.

If this charge was effective and was to apply to all of the royalty payments of Activision Blizzard made to offshore jurisdictions, then we estimate that €325m of royalty payments would be subject to the charge, raising tax revenues of €65m (£57.2m) a year.

This is on the basis that Activision Blizzard’s revenue from the UK comprises about 25% of its non-UK revenues, and so the charge should be applied to 25% of the royalties being moved from the Netherlands company to Bermuda and Barbados.5

However, at the moment, we believe that the tax would only apply to royalties paid to the Dutch C.V. with an address in Bermuda, ATVI C.V.. This would result in a bill of approximately €32.5m (£26.1m).6

ATVI International SRL in Bermuda will not be subject to the charge because, as we noted in our report on the royalties tax, the UK government will only apply the charge to royalties shifted to countries where the UK does not have a full tax treaty. This excludes Barbados, and other tax havens such as Ireland, Switzerland and others from the charge.

The UK government is also expecting large multinational companies to restructure their activities into tax havens which have a tax treaty with the UK in order to avoid the charge, and have given them a long run-in to allow them to do this. It is our expectation therefore that when the charge becomes effective in the 2020/21 tax year the internal royalty payments of Activision Blizzard will not be taxed in the UK.

King – Revenues in 2018 $2bn ($599 EMEA)

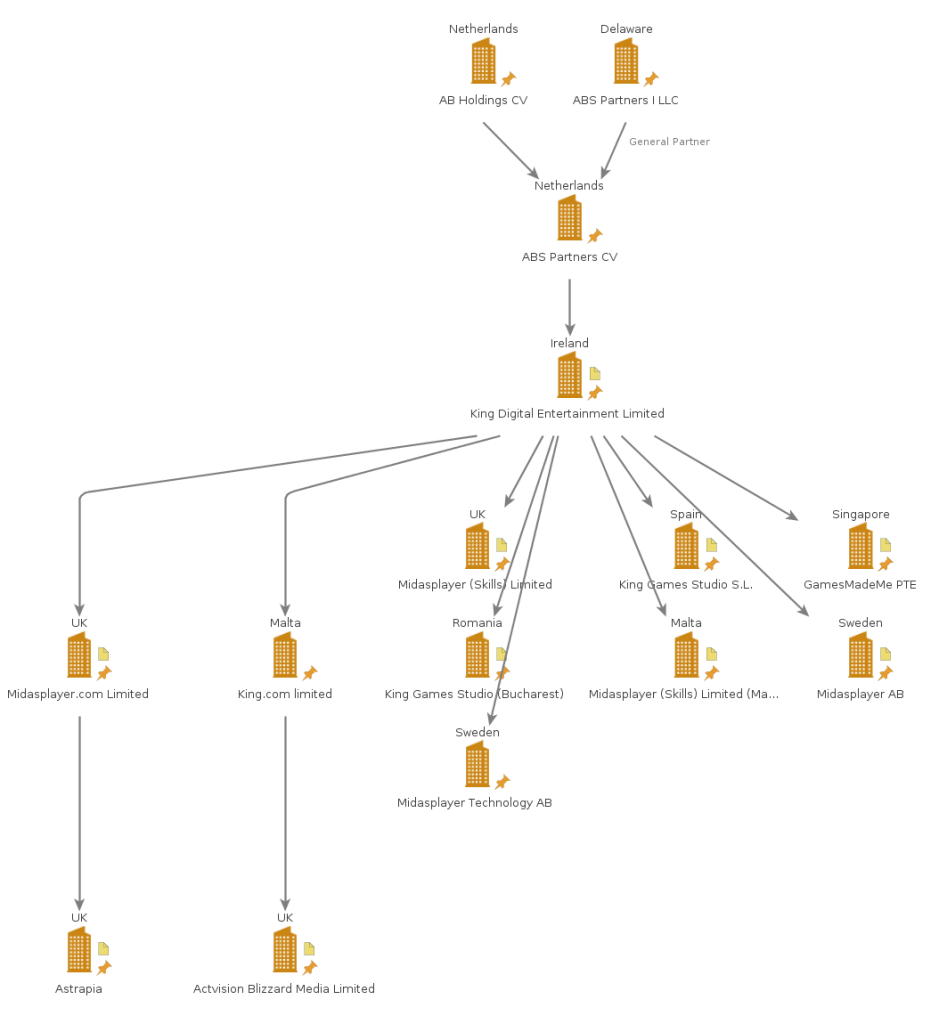

Selected companies from the King group

King was established in Sweden in 2003 by an Italian, Riccardo Zacconi, and a group of British and Swedish investors and games designers.7 The company makes games for mobile phones, including the hugely popular Candy Crush.

In 2005 the company attracted investment from Apax Partners, the private equity firm, and was floated on the New York Stock Exchange in 2014. Activision Blizzard bought the company in 2016 for $5.9bn.

When the company was floated on the stock exchange it used a holding company based in Ireland, King Digital Entertainment PLC.8 This appears to have had no substantial operations. The address of the company is a lawyer’s office in Dublin which also houses several other companies.

King Digital Entertainment PLC is owned by a Dutch partnership, ABS Partners C.V.. This partnership is registered to an address in Bermuda, and is controlled by two partners, a general partner, ABS Partners I LLC, located in Delaware, and AB Holdings C.V., another Dutch partnership with a Bermudan address.

The accounts of King Digital Entertainment state that the records of the company are held in London, and several directors give addresses in London, which suggest that London is where the management of the company takes place.

King operates from a large office building in Soho, Ampersand House, where the company employs over 450 staff. Ampersand House is the home of a number of companies that are subsidiaries of King group, including midasplayer.com Limited, which describes its activities as providing “management services” to the King group. This would further confirm that the group is managed from Ampersand House in London.

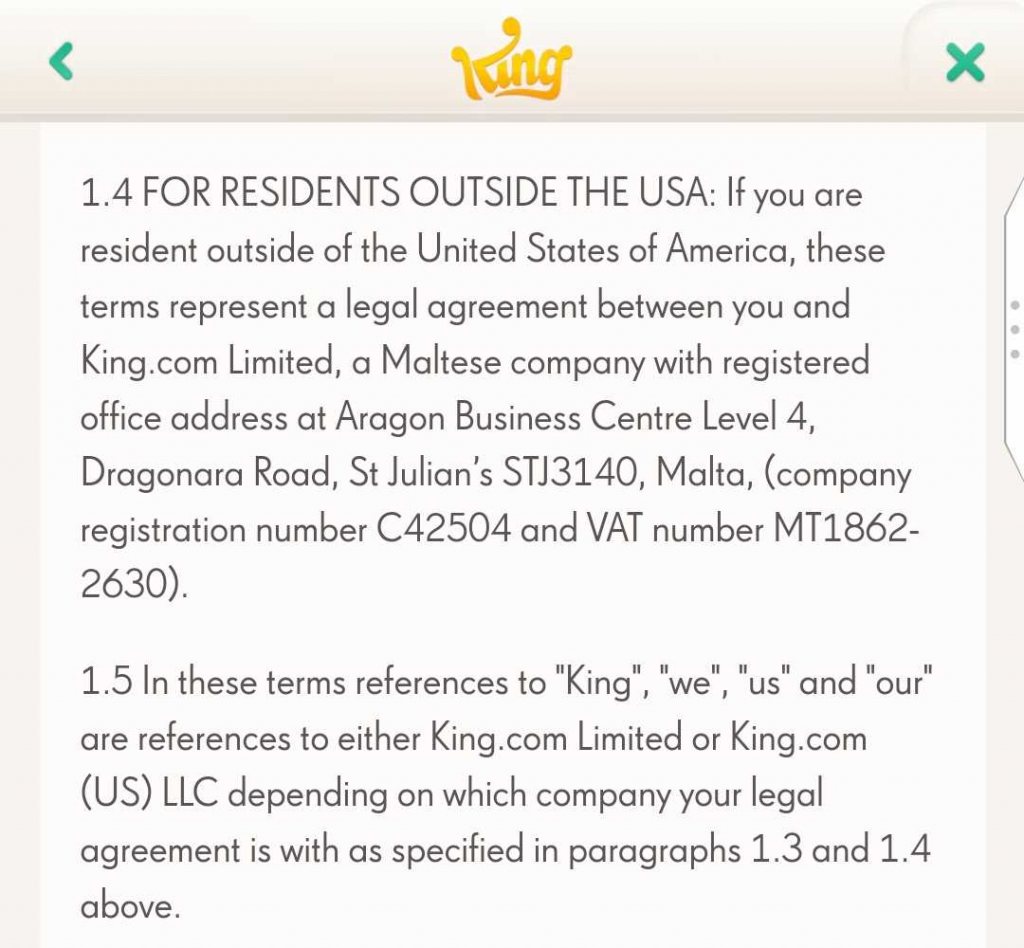

Terms and Conditions of Candy Crush

Midasplayer.com Limited is a substantial operation, it earned revenues of $283m (£259m) in 2017 and made a profit before tax of $112 (£82), on which it paid taxes of $17.7m (£19m) (the company, although based in the UK states its accounts in US $). However, as described below, it does not make its money from customers, but from fees charged to other group companies for its management services.

King has further development studios in Sweden, Romania, Singapore, and Spain. It also has sales and marketing operations around the world.

When you download Candy Crush onto your phone outside of the US, the terms and conditions state that you are contracting with King.com Limited in Malta. Users inside the US are contracting with a Delaware LLC.

This would suggest that the revenues of the company are earned by these two subsidiaries.

The development companies, sales companies and head office in London act as contractors to other companies in the group, presumably King.com in Malta and the Delaware LLC.

As disclosed in the Activision Inc accounts in the US, the King group is currently under investigation for its transfer pricing structure by numerous tax authorities including the UK and Swedish tax authorities.

The transfer pricing issue is likely to be about whether the services provided by King group companies in the UK and Sweden were being adequately compensated by the revenue generating parts of the business. If they were underpaying for services, then this would depress revenues in these units and taxable profits in the UK and Sweden.

The transfer pricing issue is a long running issue and dates back to before the purchase of the King Group by Activision Blizzard Inc. Note 18 of the latest Activision Blizzard 10-K states that the company had assumed an uncertain tax position of $74m relating to transfer pricing matters. It states that it is in discussions regarding both its pre and post-acquisition transfer pricing structure.

In the 2015 accounts of the Irish holding company, the last year before the company transferred to Activision Blizzard, the company discloses that it is in discussions with various tax authorities about its transfer pricing position and estimates its “transfer pricing exposure” to have been $62.1m in 2015.9

The disclosure in the Activision Blizzard Inc 10-K confirms that the discussions are still ongoing and that the potential liability is still increasing.

In addition to the transfer pricing issue, the Activision Blizzard 10-K discloses that the Swedish tax authority has also landed King with a $400m tax bill concerning an “alleged intercompany asset transfer”. This is likely to concern transactions made when the company was sold to Activision Blizzard. Activision Blizzard state that they intend to vigorously contest the claim.

Conclusions and recommendations

Activision Blizzard has a highly complex corporate structure, which involves subsidiaries in Malta, the Netherlands, Ireland, Bermuda and Barbados. When analysing the money flows around these companies, it seems clear that these structures are designed to minimise taxation on the profits made by Activision Blizzard outside of the United States.

The company says it is now seeking to engage with tax authorities to see what the appropriate amount of profit and tax is in the countries where they operate. However, given that the company has told investors that it will “vigorously defend” large claims for back taxes being made by the Swedish and French tax authorities, it would suggest that what Activision sees as appropriate may not match the expectations of those working in various tax authorities.

Whatever new structures and policies the company may put in place in the future, their accounts demonstrate that up until now billions of dollars were moved into a company with an address in Bermuda which appear to be entirely untaxed. It is possible that if we were able to access the accounts of the company in Barbados and Malta, billions more going untaxed would also be revealed.

It seems that revenue authorities around the world are finally taking action over the tax avoidance activities of Activision Blizzard. However, the relatively small amounts of taxes being sought by the UK tax authority highlights the difficulties of administrative action. To end these practices will also require a more robust policy response.

The use of royalty payments to move billions in profits to offshore tax havens is common in the digital sector. The UK government has tried to introduce rules to deal with these schemes, however, these new rules are known to be ineffective because of the way in which a number of tax haven jurisdictions are exempt from them.

The case of Activision Blizzard is just another example demonstrating the need for governments to introduce more effective measures to deal with royalty-based tax avoidance schemes. In the UK this means changing legislation to make sure that royalty payments made to companies in jurisdictions where the UK has a tax treaty are included in the charge to income tax.

1The various tax issues are set out in Activision Blizzard’s 10-K form, available from the company’s website. https://investor.activision.com/annual-reports

2The licensing arrangement between the various Activision Blizzard companies are described in note 3 of the ATVI CV annual accounts 2017

3See Activision Blizzard UK “Business Review”, part of the Strategic Report to the 2015 Activision Blizzard annual accounts.

4HMRC Internal Manual, Limited Risk Distributor, available from https://www.gov.uk/hmrc-internal-manuals/international-manual/intm441080

5The Activision Blizzard 10-K form states that the UK comprises 12% of total revenues, compared against the stated revenues from the non-US parts of the business this makes up 25% of non-US revenue.

6The UK government has said it will not apply the charge to income tax on royalties to companies in jurisdictions with which the UK has a full tax treaty. In order to gain treaty benefits a company must be subject to taxation in that jurisdiction. The Dutch CV is a tax exempt entity in the Netherlands, so we assume the tax would apply to that entity.

7Juliette Garside, Who are the Candy Crush millionaires?, Guardian, 25 March 2014 https://www.theguardian.com/business/2014/mar/25/candy-crush-king-flotation-king-entertainment-shareholder-windfalls

8Prior to King’s floatation on the stockmarket, its holding company was in Malta. In order to facilitate the listing the company established a new holding company in Ireland. Details are on the company’s registration form at the Securities Exchange Commission website – https://www.sec.gov/Archives/edgar/data/1580732/000119312514056089/d564433df1.htm

9See note 10 of the 2015 annual report of King Digital Entertainment PLC