A new National Audit Office enquiry to which TaxWatch gave evidence finds that large business ‘compliance yield’ – unpaid taxes that were recovered or prevented by HMRC’s efforts – has doubled over the last three years. That begs the question: are the UK’s biggest companies avoiding paying their due taxes more than previously?

Parliament’s Business and Trade Committee says tax compliance is crushing small businesses. HMRC says small business tax abuse is out of control. Can both be true?

The annual Sunday Times’ Tax List claims to show the ‘unsung heroes’ who are the UK’s Top 100 taxpayers. And there are tax heroes who are paying their fair share. But not all that glistens is gold…

On 13 January, Parliament’s Treasury Select Committee grilled HMRC’s chief and senior staff about their efforts to tackle tax avoidance, evasion and tax debt. MPs referenced TaxWatch research and investigations in questions about corporate tax reliefs, recruitment, penalties for enablers of tax evasion, and the ‘offshore tax gap’. There was good news in some of the responses – but others raised more questions.

HMRC has promised that from 2026 it will transform the way it uses digital tools to tackle tax evasion and interface with taxpayers. With the clock ticking, here are five things we found out this year about how HMRC’s digital transformation – including Making Tax Digital – is going.

At the very moment the Chancellor was searching for fiscal headroom at last week’s Budget, just across Parliament Square UK ministers and representatives of some of the world’s most important offshore financial centres were presiding over another year of drift and broken promises on tackling offshore secrecy.

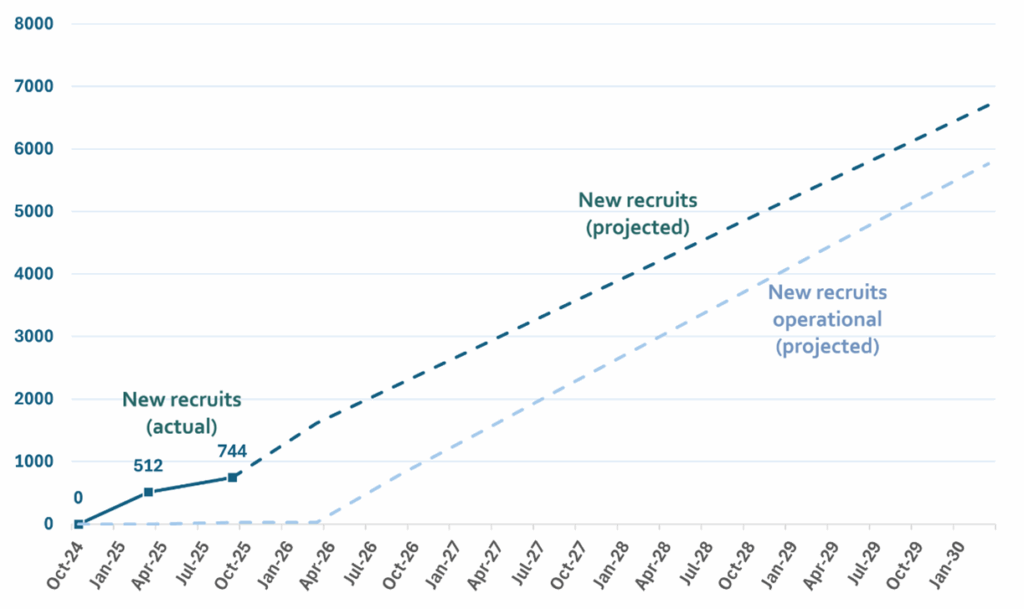

The Budget’s third-largest tax pledge relies on a UK tax authority that is suffering from recruitment delays and unfinished IT systems. Just 26 of 6,700 extra compliance/debt staff promised by Chancellor are so far in post. A key tax to counter digital giants’ profit-shifting will remain despite Trump pressure, but the Budget has missed opportunities to tackle abused corporate reliefs now as large as the child benefit budget.

Though it’s been absent from the pre-Budget debate, the Chancellor’s second-biggest revenue-raising policy so far is a plan to boost HMRC’s personnel & systems: recruiting 6,700 more staff to chase an extra £15.5 billion of evaded tax and tax debts. Yet TaxWatch has found that just 26 of these promised new staff are yet in post, calling into question a key plank of the government’s tax and spend plans.

In the run-up to a make-or-break Budget, TaxWatch’s new State of Tax Administration report takes a deep dive into how HMRC has been running the tax system over the last year.

A tax deal for US multinationals backed by Chancellor Rachel Reeves could hand US companies a $40 billion annual tax break next year, including some $6 billion for US tech giants, according to new analysis from TaxWatch.

Previously undisclosed figures show that a single large pharmaceutical company has received a £3.4 billion tax cut – including £486 million in 2024 alone – from a little-scrutinised tax incentive supposed to stimulate UK innovation, jobs and manufacturing, even though that company has cut UK jobs and shut down UK factories.

As the US President prepares to fly into the UK with tech bosses in tow, a new briefing from TaxWatch shows that the US government and tech industry representatives have made strongly inaccurate claims about the UK’s Digital Services Tax.

Successive governments have rejected calls for a tax advice regulator and minimum professional standards, which exist in many other countries from Australia to Germany. It’s high time that UK taxpayers got similar protections.