A debate was held in the House of Commons yesterday on the Government Response to the Sir Amyas Morse Review of the Loan Charge. Ahead of this we published an explainer on what disguised remuneration is here, and a more detailed briefing here. David Davis, Ruth Cadbury, and Julian Lewis were able to secure the debate on the motion “That this House believes that the Loan Charge is an unjust and retrospective tax; notes that the law on the Loan Charge was not settled until 2017; and calls on HMRC to cease action on loans paid before 2017.”

The Loan Charge is an anti-tax avoidance measure introduced in the 2016 budget to address tax lost to the Treasury from loan based disguised remuneration schemes.

These schemes involved employees and contractors being paid in loans. As loans do not incur income tax, those using the schemes ended up getting their earnings tax free. The only cost to using a loan scheme was the fees charged by the operators of around about 13%.

As a result, loan scheme users ended up keeping far more of their income than those who paid tax in the usual way.

David Simmonds MP lays out the issue in that “the schemes themselves were lawful because it was lawful to receive a loan, but the money the constituent received was tax-free only if it was genuinely a loan”. Simmonds goes on to say that as 20 years have since elapsed, that there was no evidence that these were genuine loans, hence HMRC’s interest in the schemes. He then goes on to say that taxpayers raised the issue with him that they find it hard to believe that anybody thought that they could describe their pay on a tax return as a “loan”, and because of this never have to pay any income tax on it.

HMRC argues that these loans should really be classed as income because no one had any expectation that they should be paid back, and as such should always have been liable to income tax.

The Financial Secretary to the Treasury, Jesse Norman, described these schemes as “contrived tax avoidance in which people are paid in the form of a loan with no interest and no intention or requirement to pay the loan back.” Many of the schemes saw money routed through offshore companies and trusts.

Norman summarised the case for the charge in saying “it has cost the Exchequer hundreds of millions of pounds a year, and that, of course has two effects. It deprives public services of the money they need to operate, and it forces other taxpayers to pay more in order to make up the shortfall.”

The charge has become one of the most controversial pieces of tax legislation in recent times. A cross-party group of MPs, the Loan Charge All-Party Parliamentary Group has led the fight in campaigning against the Charge. In January of last year the Treasury was forced to agree to review the loan charge proposals, following an amendment to the Finance Act tabled by the Liberal Democrats MP Ed Davey. The former Comptroller and Auditor General Sir Amyas Morse was tasked to lead the independent review

A number of recommendations from Sir Amyas’ report were accepted last December, including halving the time period in which the loan charge would apply, from 20 years to ten. However, many campaigners and Members of Parliament do not believe these measures go far enough. MP’s have argued that the law was not agreed upon until 2017, and are urging the government to go further, with one of the key criticisms being the retrospective nature of the charge.

Adam Smith was frequently quoted in the debate, given that the Financial Secretary to the Treasury had written a book on the economist. The Conservative MP for New Forest West, Sir Desmond Swayne, said that following the principals of taxation put forward by Smith, tax should not be retrospective.

The Financial Secretary to the Treasury disagreed with the characterisation of the tax as retrospective. Mr Norman said of the Loan Charge “it taxes a loan outstanding at a future date. It does not change any law previously on the statute book.”

Peter Dowd MP, speaking on behalf of HM Opposition, stated that Smith also argued to “Take from the taxpayer only that which is needed for the public realm”, and that if people do not pay their taxes, everyone else has to pay more.

Dowd went on to frame the loan charge within the conditions HMRC is facing, referencing that “A third of its staff have gone since cuts in 2005 and later in 2010. Any increases in the cash amounts available to HMRC for its running have, in effect, been blocked”.

While Christian Matheson MP argued “nobody in this House disputes the fact that it was tax avoidance”. This does not appear to be a view shared by all, with Paul Holmes MP stating “the people this affects are not tax avoiders”, and Bob Stewart MP describing his constituents who entered into these schemes as “decent and honest”.

Kevin Hollinrake MP said that those people using such schemes should have been aware that entering into a scheme where you can lower or eradicate your tax bill was wrong. In an intervention during the speech of David Davis, Hollinrake said “If something looks too good to be true, it usually is? In my business, we have been brought this kind of scheme a number of times by our advisers over the last 30 years, maybe with a barrister’s letter saying, “Don’t worry. It’ll be fine. You can reduce your tax bill hugely by adopting this scheme.” We have always rejected them because we knew the risk.”

Both the advisers who ran the schemes and HMRC came in for criticism during the debate. It was argued that instead of charging the individuals that took out these loans, that HMRC should instead be pursuing the advisers who sold them. Paul Holmes MP stated, “many people were advised by financial advisers and are now being penalised because of the late realisation and intransigence of HMRC”. David Davis went further, in calling the advisers and employers who facilitated the loans “villains”.

In Norman’s final remarks, he summarised the argument as thus “If one asks the average man or woman in this country, I think they would say, “Everyone should pay their fair share of taxes. People are responsible for their own tax affairs. Real loans get repaid; if someone offered you a loan for which no repayment, no tax and no interest was due, it would probably be too good to be true.” And so it is.”

Despite this – the motion from the Back Bench committee asking that the loan charge only applies to loans taken out after 2017 was agreed to. Where this leaves the government is unclear.

The debate is available on Parliament Live here.

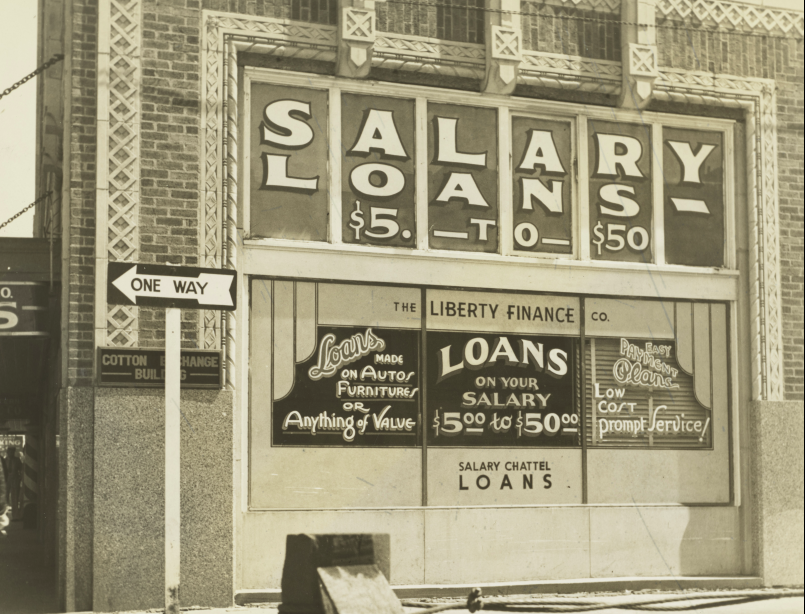

Photo by The New York Public Library on Unsplash