by Mike Lewis | Feb 12, 2026

Parliament’s Business and Trade Committee argues in its latest report, released yesterday, that tax compliance is crushing small businesses. Aside from concerns about tax levels and thresholds (about which there is much more to say, especially regarding VAT and...

by Mike Lewis | Jan 14, 2026

Yesterday (13 January) Parliament’s Treasury Select Committee grilled HMRC’s chief and senior staff about their efforts to tackle tax avoidance, evasion and debt. MPs referenced TaxWatch research and investigations in questions about corporate tax reliefs,...

by Mike Lewis | Nov 26, 2025

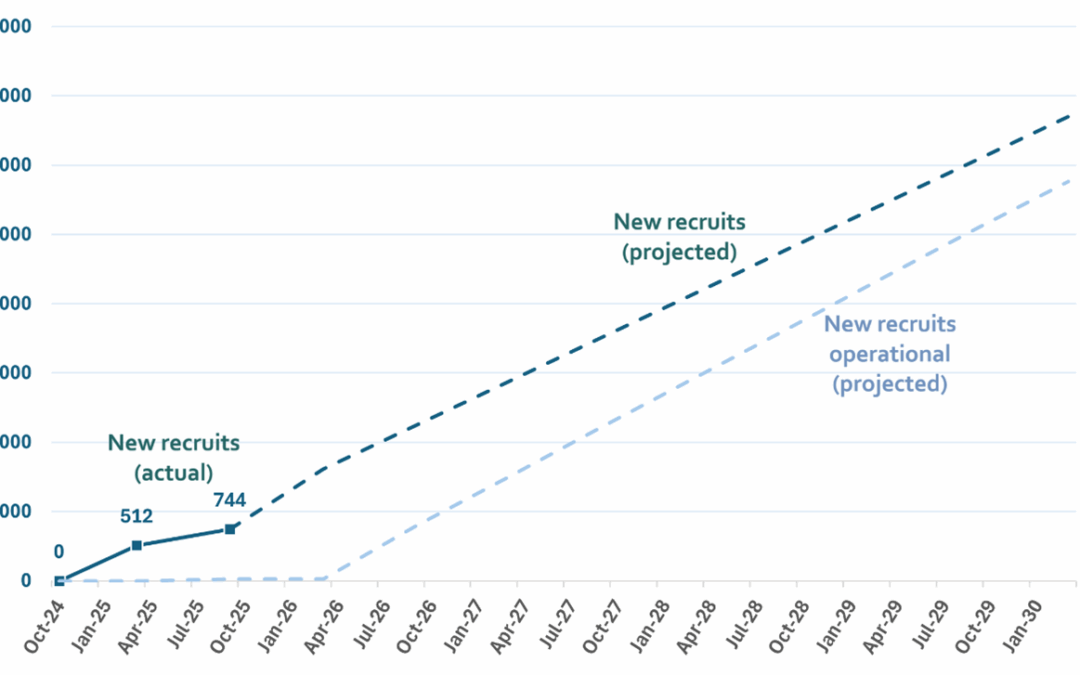

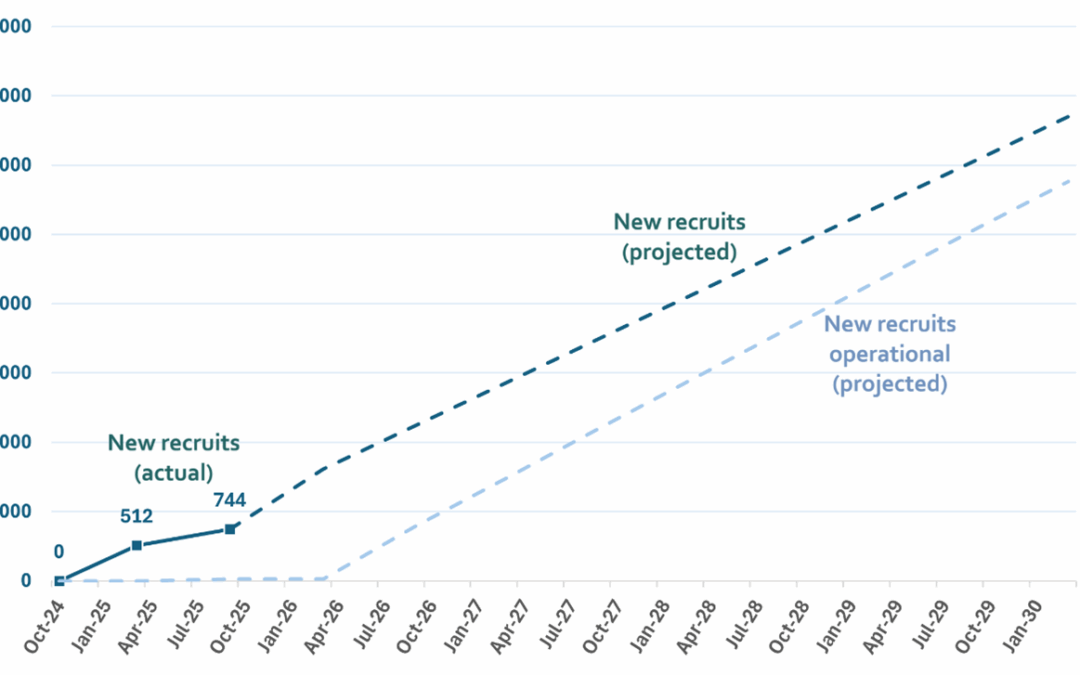

Budget’s third-largest tax pledge relies on UK tax authority that is suffering from recruitment delays and unfinished IT systems Just 26 of 6,700 extra compliance/debt staff promised by Chancellor are so far in post Decision to retain tax on digital...

by Mike Lewis | Nov 19, 2025

What is Rachel Reeves’ second-biggest revenue-raising policy so far? As well as being a question for the most niche pub quiz ever, It’s something that would be near-impossible to guess from the public debate in the run up to this year’s Autumn...

by Mike Lewis | Nov 19, 2025

Full report HMRC is under pressure. Generational demands on key areas of public spending from defence to social care to special educational needs; a Treasury adhering to strict fiscal rules on borrowing; and a government struggling to minimize breaches of its...

by Mike Lewis | Nov 15, 2025

Estimating the impact of exempting US-headed groups from Pillar 2 taxes Full report On 28 June 2025, the UK Chancellor and other finance ministers from the G7 group of countries (Canada, France, Germany, Italy, Japan, the UK and the US) unilaterally announced that in...