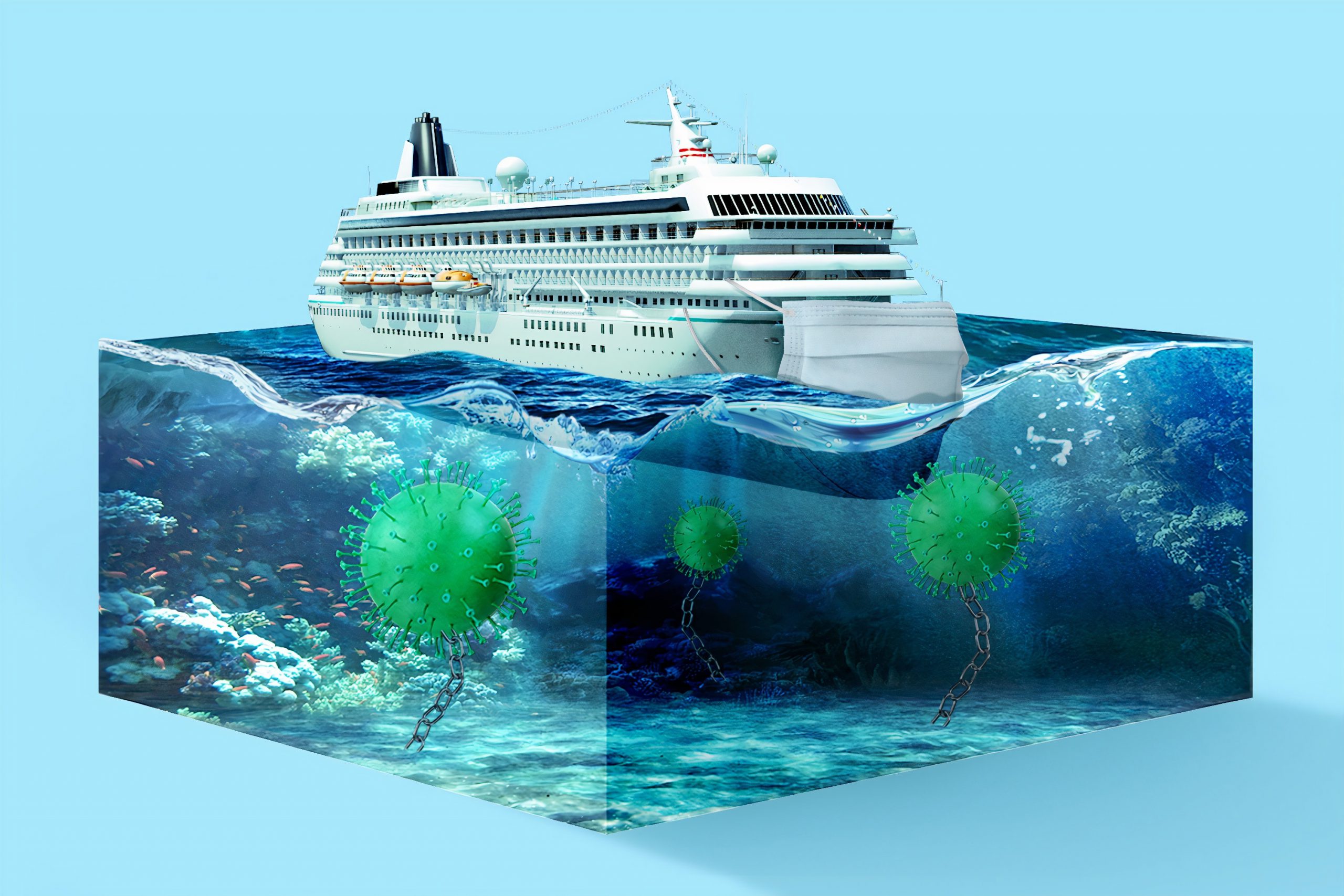

The cruise ship industry was an early casualty Covid-19, with all major cruise operators being forced to halt their operations.1 This has hit the industry hard, with share prices in the largest cruise companies dropping by over 50 per cent compared with this time last year.

The impact of the virus on the industry became the first flashpoint in the debate about which companies should get state support. Following fierce debate in the United States over whether their decades long use of tax havens should disqualify them from receiving support, it appears that the industry can not access Federal support under the CARES Act. However, with little fanfare, the Bank of England has loaned £325m at low interest to the two largest cruise lines. both of which are renowned for their use of tax havens.2

Cruising for a tax deduction

By incorporating in places such as Panama (Carnival Corporation) and Liberia (Royal Caribbean Cruises), and registering ships in countries such as the Bahamas, as well as making use of a number of generous tax exemptions, cruise ship companies are able to avoid tax and are held to lower standards on health, safety, the environment, and labour rights.

A report by The Hustle calculated that the major cruise lines, all with a significant presence in Florida yet incorporated offshore, paid an average tax rate of just 0.8 per cent.3 A recent investigation by Business Insider found staff on cruise ships working long hours for as little as $500 a month.4 Carnival Corporation & Plc has recently been fined $20m for dumping sewage and plastic waste into the ocean, while falsifying records of incidents.5

America to the rescue?

In the US, President Trump has praised the cruise industry , calling these offshore companies “a great US business” during a press conference.6 The President has had a long association with the industry. Micky Arison, chairman of Carnival, is a personal friend of Trump and helped sponsor his reality show “The Apprentice”.7

Not everyone agrees with Trump’s analysis of the industry. Peter DeFazio (D-Ore.), chairman of the Transportation Committee, commenting on the industry’s request for a bailout has said “they aren’t American”, and “They don’t pay taxes in the United States of America. If they want to re-flag their ships … and pay U.S. wages and pay U.S. taxes, then maybe.”8

Despite the President’s fondness for the industry, it appears that it does not qualify for relief under the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”). As companies must be certified as “created or organized in the United States or under the laws of the United States” as well as having “significant operations in” and a majority of employees based in America.9 Despite all the major players having a presence in Florida, this effectively rules them out. 10

Carnival Corporation’s annual 10-k filing goes as far as to state that “…substantially all of Carnival Corporation’s income is exempt from U.S. federal income and branch profit taxes”, due to the fact that Section 883 of the Internal Revenue Code exempts “income derived by a corporation organized in a foreign country.”1112 Norwegian said in its most recent annual filing that under “current Bermuda law,” where it’s incorporated, the company is “not subject to tax on income and capital gains.”13

British bailouts

In a similar fashion to President Trump, the British Prime Minister has recently referred to the cruise industry as “a great, great British industry”, stating that the UK “will support it in any way that we can.”14 Though the rhetoric is the same, while the US isn’t bailing out the cruise industry, the UK is.

On 04 June, the Bank of England announced that £25m in Covid Corporate Financing Facility (CCFF) loans had gone to Carnival Plc, a British company that is ‘dual listed’ with the Panama incorporated Carnival Corporation.15 A dual-listed company is a corporate structure wherein two companies function as a single business. 16

On 25 June it was revealed that RCL Cruises Ltd, better known as Royal Caribbean Cruises, had received £300m in CCFF loans.17 Royal Caribbean does have a headquarters in the UK (along with one in Florida), but the ultimate owner is RCL, a company incorporated in Liberia in 1985.

In 2019, Carnival PLC declared profits of $1.2bn and faced a tax liability of just $40m. In 2018, the latest year that accounts are available, RCL Cruises Limited declared $226m in profit and received a tax credit of $59m.

We have written about how countries around the world have sought to exclude companies registered in tax havens from receiving government support, in our report, Paying in Equally. The cruise ship industry provides one powerful example of how the UK has taken a relatively easy-going approach to which companies qualify for government support. But with calls growing to place restrictions government bailouts, will the UK government’s support for the cruise ship industry be sustainable?

This research featured in The Times and Skift.

Photo by Morning Brew on Unsplash

1https://www.theguardian.com/world/2020/mar/27/stranded-at-sea-cruise-ships-around-the-world-are-adrift-as-ports-turn-them-away

2https://www.theguardian.com/world/2020/mar/27/stranded-at-sea-cruise-ships-around-the-world-are-adrift-as-ports-turn-them-away

4https://www.businessinsider.com/cruise-ship-workers-reveal-how-much-money-they-make-2019-5?r=US&IR=T

6https://www.washingtonpost.com/travel/2020/03/13/trump-offers-support-cruise-lines-during-coronavirus-outbreak-while-asking-them-stop-sailing/

7https://www.washingtonpost.com/politics/coronavirus-pandemic-tests-clout-of-cruise-industry-and-its-long-standing-ties-to-trump/2020/03/12/3f79a1ba-63aa-11ea-912d-d98032ec8e25_story.html

9https://www.whitecase.com/publications/alert/us-cares-act-relief-available-us-subsidiaries-european-companies

14https://www.telegraph.co.uk/travel/cruises/news/boris-johnson-british-government-support-cruise-industry/