As the year turns, 2026 will see the start of the biggest change in a generation for how nearly three million people will do their taxes: the catchily-titled Making Tax Digital for Income Tax Self Assessment (MTD for ITSA).

From April 2026, digital record-keeping and quarterly online filing using compatible software will become mandatory for sole traders and landlords with income over £50,000. Those earning over £30,000 will follow in 2027.

This may all seem a long way from high-level tax policy and multi-billion-pound tax evasion schemes. But it’s part of a much bigger shift in the administration of the UK tax system, with implications for tax compliance and the tax gap.

Threats to the tax system are increasingly digital: from mass fraudulent tax relief claims by digital relief ‘farms’, to cyber-attacks and unprecedented data leaks. The solutions, HMRC believes, are digital too: using new AI tools to spot tax evasion and non-compliance, generative AI to guide caseworkers, and new digital interfaces for taxpayers.

And this year HMRC promised to transform the way it uses digital tools to tackle tax evasion and interface with taxpayers.

During 2026 TaxWatch will be looking at some of these new tax compliance threats, super-charged by social media, online commerce and cryptocurrency.

But part of TaxWatch’s mandate is also to look at how tax administration is working on the ground, including in our annual omnibus report, The State of Tax Administration.

With the clock ticking, here are five things we found out this year about how HMRC’s digital transformation – including MTD for ITSA – is going.

1. Nearly a fifth of MTD digital interfaces aren’t yet fully tested and functional

While MTD is meant to simplify and digitise tax, the technical readiness of HMRC’s infrastructure remains a major concern.

One developer of specialist tax and accounting software for the property industry told us that many of HMRC’s digital interfaces for MTD (APIs) are still in beta. Their concern: testing might happen with real taxpayer data, raising privacy issues and the potential for calculation errors. HMRC themselves told us that “less than 20 percent” of the MTD APIs are not yet “stateful” i.e. that they do not remember changes previously made…suggesting that up to 20 percent are not stateful, and thus can’t be fully tested yet, less than six months out from mandatory use by taxpayers.

2. Gaps in online services are pushing taxpayers back to the phone

HMRC’s support channels, already stretched, are likely to come under even more pressure once MTD rolls out.

“HMRC may not be able to deal with the flood of questions in time,” one leading tax software developer told us. “Taxpayers will be risking confusion, non-compliance, and penalties unless there’s enough support.” CIOT also points to a lack of clarity about who helps with what: will it be HMRC or the accounting software provider?

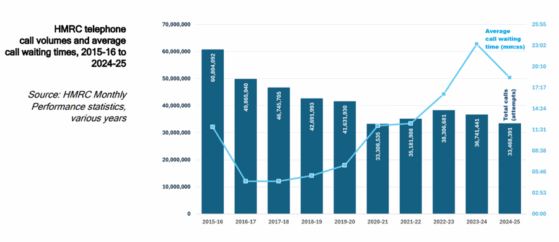

This extra pressure comes on top of ongoing challenges in HMRC’s taxpayer-facing systems. After a £51 million funding boost in 2024 for answering calls and correspondence, the average call waiting time fell for the first time since 2016-17 to a (still mammoth) 18 ½ minutes. This is still four times longer than in the mid-2010s, when HMRC was receiving nearly 50 percent more calls. In 2024-25 taxpayers and their agents spent over 1,186 years collectively waiting on the phone to HMRC, and 6.5 million calls – nearly 20 percent of all calls – were unanswered.

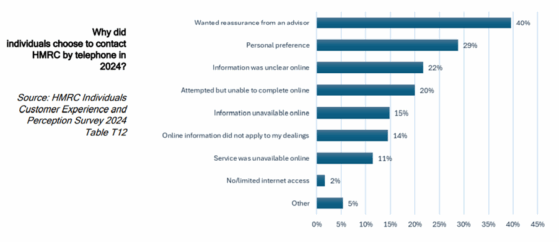

HMRC’s response is to do more online. But over a fifth of all calls from individual taxpayers are precisely because online services didn’t work in the first place, were unavailable for the problem, or were unclear.

3. Awareness is low

3. Awareness is low

Across the board, professionals agree: many affected taxpayers still don’t know what MTD is, or how it will affect them.

“Many sole traders are still unaware of what MTD for ITSA actually involves,” says the MD of one major accountancy chain we spoke to. They argue HMRC needs to focus on jargon-free education.

Others echo this concern. The Association of Taxation Technicians (ATT) and Low Incomes Tax Reform Group (LITRG) both highlight unrepresented taxpayers, those without accountants, as being particularly at risk of falling behind. “This will be an uncertain time for many,” says the LITRG, calling for better signposting and specific help for those with extra support needs.

4. Costs are up, benefits are down

MTD for ITSA is one of HMRC’s largest projects. During 2024-25, projected costs increased from £885 million to £1.4 billion, while HMRC’s own estimate of the additional tax yield from the programme has been revised down (from £6.3 billion to £4.3 billion).

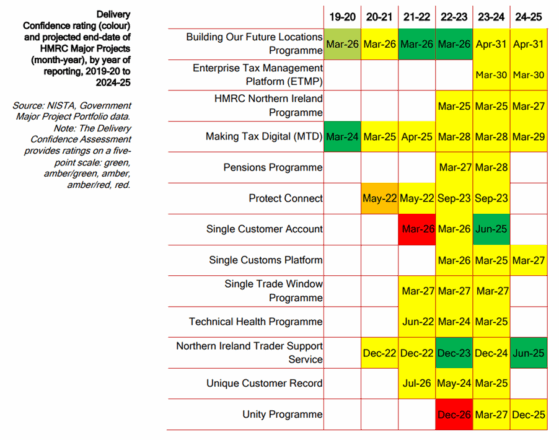

HMRC currently has seven major modernisation projects on the Government Major Projects Portfolio (GMPP), down from thirteen in 2023-24 following a surge in new projects in 2021-22 and 2022-23. But only two HMRC projects left the GMPP this year because they were successfully delivered: the Single Customer Account and the Technical Health Programme. The other four were either put on ice, or simply no longer qualify as a major project.

HMRC’s major projects have expected lifetime costs of £4.7 billion and expected monetary benefits of £6.9 billion. All but one project are rated ‘amber’ for Delivery Confidence, meaning delivery is considered feasible but with significant issues requiring active management. Although there has been some improvement in delivery confidence ratings over time, most projects have experienced significant delays and cost increases.

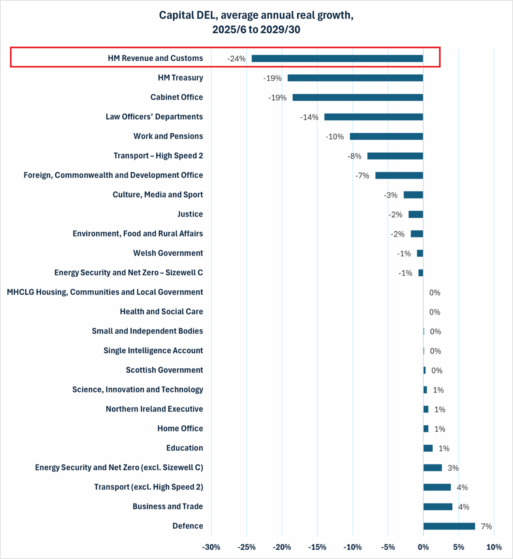

More worrying is the fact that HMRC’s digital transformation looks capital heavy, yet HMRC received the biggest capital budget cuts of any Whitehall department – 24% in real terms – in this year’s government Spending Review. Some capital spending might be shifted to day-to-day expenditure by buying software-as-a-service – though this will lead to more baked-in reliance on external providers. And there will be capital savings from the ongoing programme to shrink HMRC’s building estate – though this won’t be complete until at least 2031. Nonetheless funding new digital tools and systems looks challenging against HMRC’s current budgets.

5. The jury’s still out on whether previous ‘Make Tax Digital’ has improved tax compliance

MTD has been mandatory for VAT since April 2022. It doesn’t seem immediately to have helped the VAT tax gap – HMRC’s estimate of unpaid VAT. This rose from 5.9 percent of total VAT liabilities in 2021-22 to 7.8 percent of total VAT liabilities in 2022-23, a nominal increase of £4.7 billion (though it has begun to drop in 2023-24, in line with a longer-term downward trend).

***

HMRC’s Digital Transformation promises a lot. And there’s no questioning the need for it: digital threats and solutions to administering the UK’s tax system are going to be ever more important. But they will need time, money, clear objectives, and bringing taxpayers along for the ride. In all four areas, there’s still much to do. And with MTD for ITSA coming in April 2026, spare a thought for the HMRC staff for whom Christmas and the New Year is going to be even busier than usual…

***

Main image: Centers for Disease Control and Prevention / Unsplash